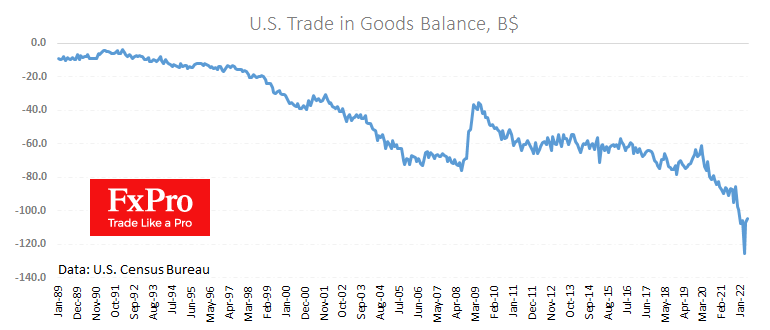

The US merchandise deficit narrowed to its lowest since the end of last year at 104.3bn compared to 106.7bn in April and 125.7bn in March.

The record deficit in March was triggered by panic buying a wide range of goods due to the military conflict in Europe, which started a surge of imports to 294bn. After that we see two months of imports falling to 280bn in May.

However, exports have also risen since April, as America began to substitute Russian oil and gas for the European market.

Although it is hard to predict that changes in geopolitics will solve the persistent problem of the US goods deficit, it could nevertheless start a remarkable recovery, giving additional support to the dollar.

However, America could do much more to stimulate oil and gas production, taking away Russia’s share. But investments in hydrocarbon production are struggling to fit into the ESG agenda and are further strained considering rising interest rates.

The FxPro Analyst Team