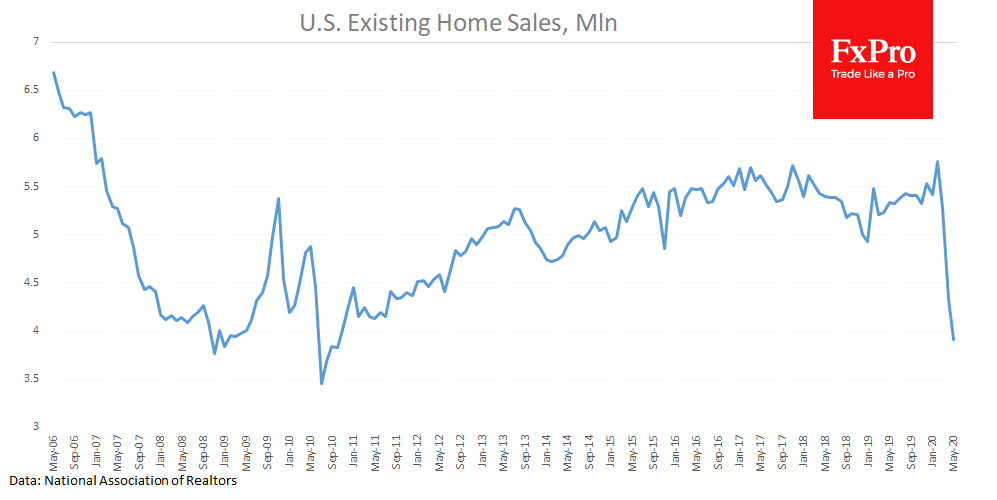

In May, home sales in the United States declined for the third month in a row, dropping to the lowest level for 9 ½ years at 3.91 million. It fell by 32% to February peak levels, and by 27% to an average for 12 months before February.

These are the lowest since October 2010 and near the bottom of the mortgage crisis, when sales fell to 3.45 million. The decrease to the last year is the sharpest since 1982, but quarantine restrictions naturally explain this.

In addition to a sharp decline in sales, there are no other worries. The median price of an average house sold is 2.3% higher than last year.

Stocks of unsold homes in May rose by 6.2%, but 18.8% below the level a year earlier. The report also says that distressed sales accounted for 3%, as in April, but above 2% in May 2019.

The head of the National Association of Realtors has shown hope that the worst for the market is over and that sales will undoubtedly increase in the coming months.

The FxPro Analyst Team