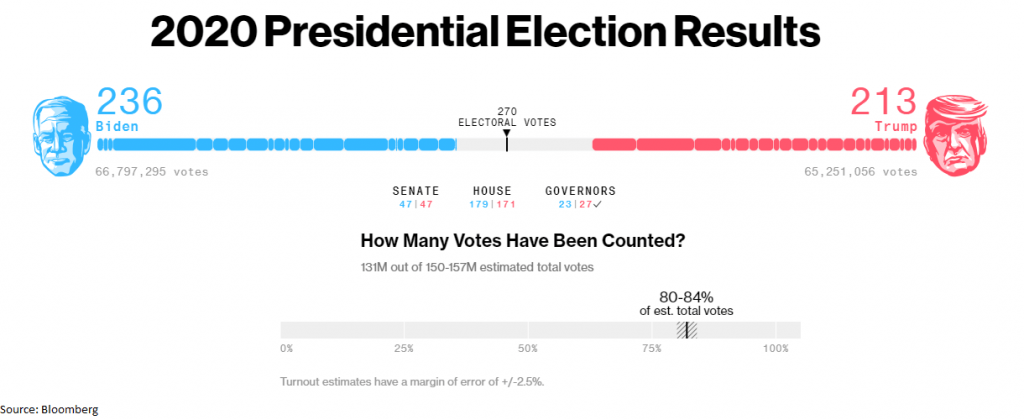

Americans have already cast their votes, all that remains now is to clarify results definitively. Preliminary results (about 85% of the votes counted) show a shaky Biden leadership. 449 out of 538 votes counted: 236 for Biden vs 213 for Trump.

Interestingly, the markets are reacting very calmly. Four years ago, futures on indices fell about 5% on Donald’s sudden strong results but turned to growth after his winning speech. During this time, participants saw with their own eyes that Trump was not the “nightmare” for the markets that many had expected. It turned out to be the exact opposite: becoming a major market driver, reducing taxes and pushing the Fed to ease its policy. Therefore, a defeat for Trump may cause an impulsive and adverse reaction from the markets. However, this is likely to be short-lived.

Biden’s presidency promises to be more peaceful for America as a whole, so it can hardly be considered a disaster for the markets. He was Vice President under Obama for a long time, so he is also a relatively “known evil” even though he promises to raise the taxes. Besides, in the short term, an economic aid package of over $2 trillion can be adopted by Biden very quickly.

Many statements have been made about which sectors of the economy will succeed under Biden, but there is no fear among market participants that President Joe will bring long-term negative effects to the markets. As a result, investors and traders were in a hurry to buy back stock indices this week, after S&P500 touched 3200, the lower bound of the trading range since July.

The pre-election uncertainty is now approaching its end, benefiting the American currency. It has regained its losses since the beginning of the month, and the dollar index briefly touched the highs of late September. The start of the publication of election results reversed its weakening.

EURUSD, from levels around 1.1770, reversed to decline and fell quickly to 1.1600, recovering at the time of writing to 1.1650.

The current election has so far caused a more moderate reaction than it did four years ago. This is important for traders, many of whom were preparing for a sharp surge in volatility. This time, the reaction can be very time-consuming due to the high number of mail votes, as well as a very tight race and possible requirements for recounts and vote checks.

More importantly, whoever becomes the new president will first have to make decisions about helping the coronavirus-stricken economy. Both candidates are committed to supporting the position of Americans, which includes unemployment programmes and household checks. The only stumbling block is who will sign the checks and laws, and the sooner this is known, the better for the markets.

The FxPro Analyst Team