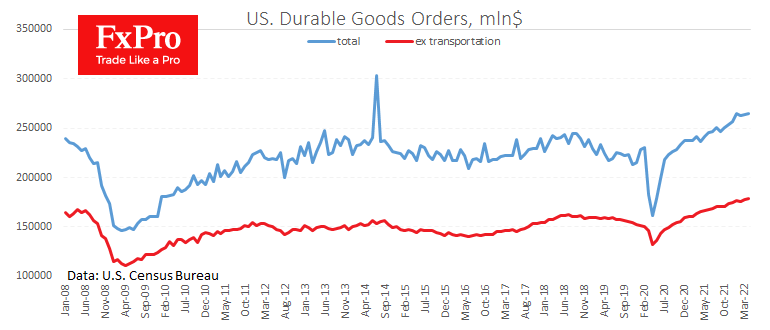

US durable goods orders added 0.4% in April after rising 0.6% a month earlier, slightly weaker than the 0.6% increase expected. Excluding transportation, orders rose by 0.3% in April, following a 1.1% increase a month earlier. This series shows steady growth, easing fears of an impending US recession.

Companies and people tend to avoid making expensive purchases in anticipation of tough times ahead, so durable goods orders are considered one of the leading indicators of the economic cycle.

This indicator points to the resilience of business demand, which is outperforming inflation with a 12.1% y/y against 8.3% y/y inflation. Such data is supportive of the Dollar reducing speculation that the Fed will cause a recession soon with its rate hikes.

The FxPro Analyst Team