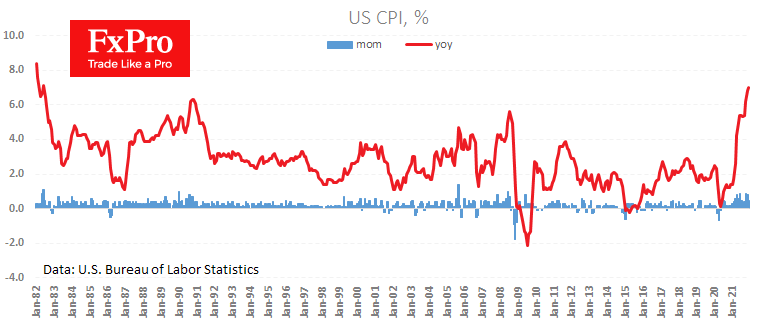

US consumer prices rose 0.5% in December, accelerating to 7.0% y/y. The core index added 0.6% on the month and 5.5% y/y. Prices excluding food and energy added more than 1.7% in the last three months, noting that inflation is creeping into the core of the economy.

However, fears of this trend may be exaggerated. Inflation data published earlier today in China showed a faster-than-expected slowdown. China could start exporting deflation again or at least stop pushing up prices around the world.

Noteworthy is the market reaction where the release put pressure on the dollar and spurred demand for risky assets: EURUSD is up 0.5% after the release, above 1.1400, Nasdaq100 is again testing the 16000 level (+0.9% so far today).

The dollar has been consolidating for a long time without much direction, so a breakout of the 1.1250-1.1350 range could start a strong momentum or even set a trend for a few months.

The FxPro Analyst Team