US jobs data will be released today, which promises to attract increased market attention and could cause a surge of volatility in the dollar and equities. In the January employment estimates, investors and traders will be looking for answers as to how active policy tightening from the US Federal Reserve will be, whether wage inflation is so entrenched and whether there are signs that the economy is already losing its momentum.

Let’s see what preliminary data we have at our disposal to prepare for the most unpredictable US indicator.

According to the ADP, private-sector employment crumbled 301k in January. The last time we saw a decline was in December 2020, but with a more modest 75k. In both cases, the cause seems to be a spike in coronavirus, which has discouraged job seekers.

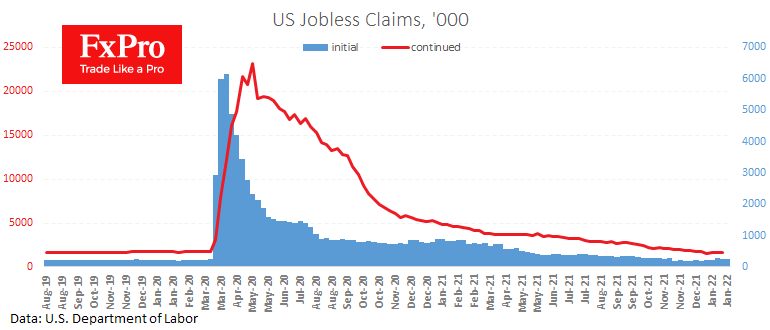

The statistics on weekly benefit claims are also supporting the cautious mood. The 4-week moving average of Initial Jobless Claims rose to 255K against 204K a month ago. This indicator has a close link to employment figures. And in this case, it also prepares us for a drop in employment in January.

ISM indicators provide markedly better labour market assessments. Both service and manufacturing employment components remain above 50, indicating growth. But this growth can be attributed to a rise in wages, not only the number of jobs.

A new consensus of market analysts suggests that employment is expected to rise by 110k after 199K in December. At the start of the week, figures near 165k were expected, but these have adjusted following the release of the indicators listed above.

If we do indeed see a reduction in employment, it will be more difficult for the Fed to push its hawkish monetary policy tightening agenda.

However, another unknown has to be considered – wages. A further acceleration in the wage growth rate could leave the US Federal Reserve with no choice but to focus all central bank efforts on cooling economic and business activity. This could trigger a recession and a sharp correction in the markets.

The FxPro Analyst Team