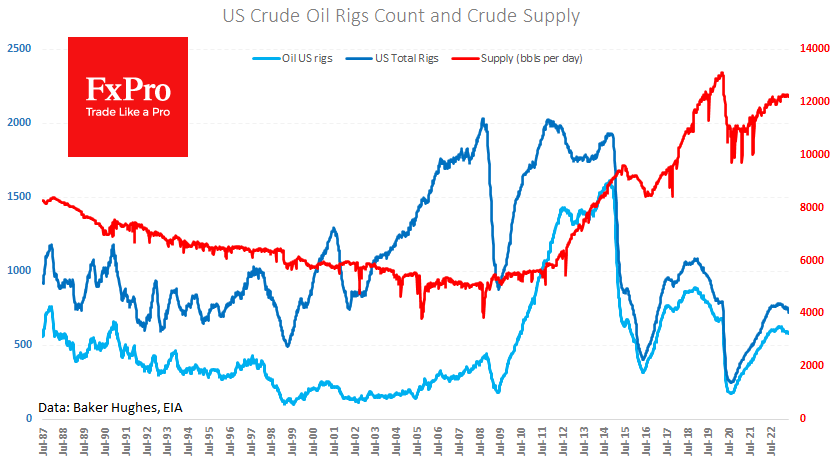

The number of active oil and gas drilling rigs in the US fell by 11 last week to 720, returning to a level seen a year ago. This indicates that producing companies focused on efficiency rather than on expansion.

Lower drilling activity will keep production growth in check over the horizon of 6-9 months, which is a supportive factor for oil prices. The $65-75 per barrel WTI price area looks like borderline territory where producers prefer to stick to the status quo.

Producers still prefer to refrain from ramping up drilling, seeing a continued sell-off in the strategic reserve. Interestingly, the administrators keep reminding us that they will soon start replenishing it.

At the same time, we urge you not to discount the economy. There are increasing signs of a slowdown in economic activity, undermining demand. It is well worth expecting that it is the factor of the economy that will be played back by the markets for the time being, causing local pressure on oil towards $65.

Falling below those levels could make oil attractive for reserve purchases. In addition, it would support a suffering industry while the inflationary threat is falling.

The FxPro Analyst Team