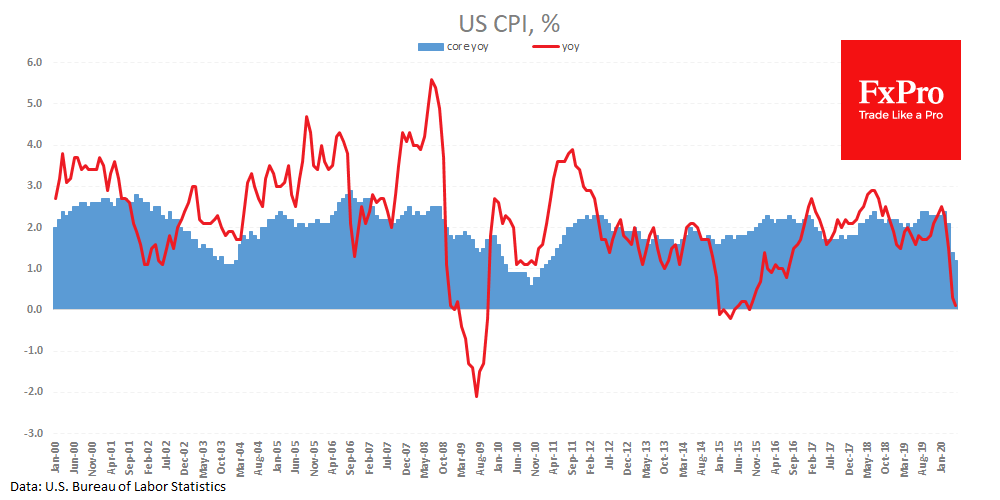

The US inflation fell short of expectations, noting a 0.1% m/m decrease to just 0.1% y/y for CPI. The fact is weaker than expectations for the third month in a row. Analysts had expected to see numbers 0.1 percentage point higher.

The same can be said about the core inflation index, which slowed in May to 1.2% y/y, the lowest since 2011. The collapse in fuel prices and auto insurance continues to push overall inflation lower. At the same time, the cost of food at home continues to take off, adding 1.0% in May after a jump of 2.6% in April. Over 12 months, the growth of this component is 4.8%. More substantial annual growth is only in the prices of medical care services, but it has added more evenly – by 0.5%-0.6% in the last three months.

Weak inflation rates give the Fed room to maintain a stimulating mood in monetary policy, while impressive food prices can increase subjective estimates of price increases and increase inflation expectations.

The FxPro Analyst Team