Financial markets ended last year with expectations of six Fed rate cuts totalling 1.5 percentage points. Speculation has been circulating in recent days that there may be no cuts at all in this one. In the previous three years, a similar or even less dramatic shift in expectations triggered spectacular shifts in financial markets, launching a dollar rally and a sell-off in equities.

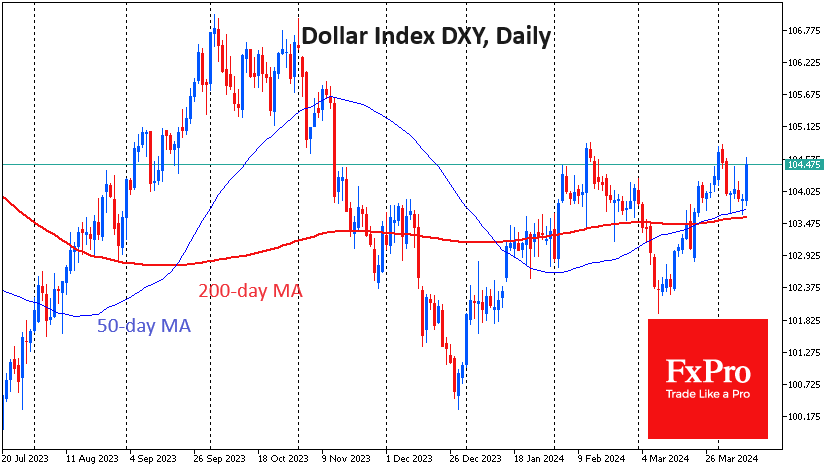

However, since the beginning of the year, the market has processed the expectations going from one extreme to another in a very unexpected way, with equities adding an impressive 9% and the dollar index adding just over 2.5%. Does this signal intrinsic weakness in the dollar? More likely, it’s a signal that market participants are seeing the fragility of current expectations.

Friday’s labour market report failed to change or unequivocally confirm the trend. Now comes the inflation report, the volatility from which has overshadowed the reaction to NFP in recent months.

Analysts, on average, are set to see a 0.3% monthly rise in prices and an acceleration in the annual pace from 3.2% to 3.4% in March. However, since October, the data has either matched or exceeded expectations.

The current report determines the fate of the Fed’s June rate decision. The odds of a cut on 12 June are now 57%, versus a local peak of 76% on 22 March and 100% at the end of February.

The Fed likes to say that the data will determine the committee’s next action. This desire not to make its forecasts is creating obvious tension in financial markets, although so far, it has not generated volatility as one might have feared.

A rise above expectations has the potential to finally spark a rising trend in the dollar instead of the current wandering with strong amplitude and little upward bias. At the same time, it could be a strong enough factor to start a 5-10% correction in US stock indices.

The FxPro Analyst Team