A tougher-than-expected consumer inflation report followed a surprisingly soft producer price report. This divergence clearly reflects the price volatility facing the economy and the complexity of assessing the central bank’s next steps.

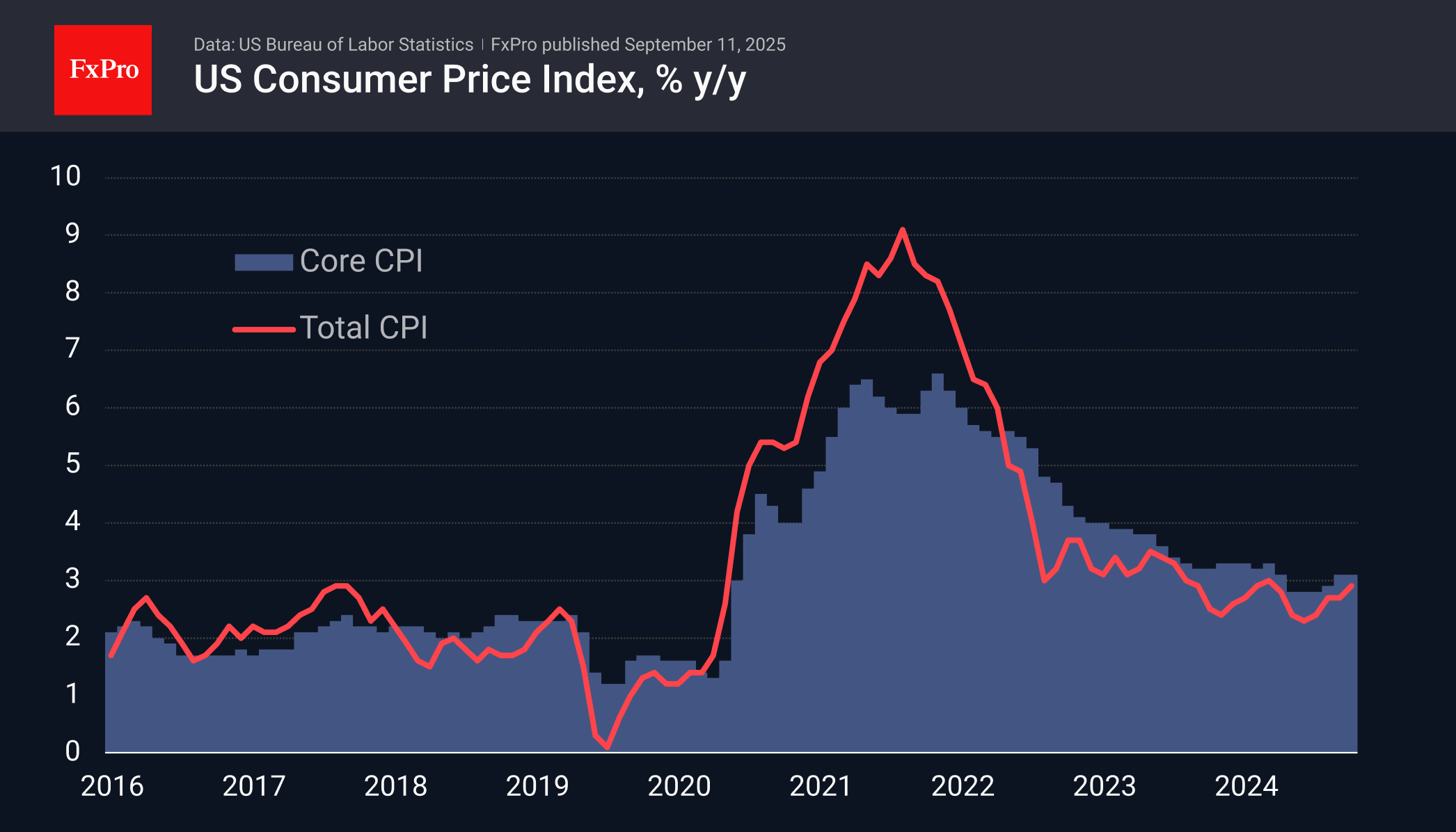

The consumer price index rose 0.4% last month, the highest since January and more than the expected 0.3%. A day earlier, average forecasts were 0.4 percentage points higher than the actual producer price figures, showing a decline instead of the expected 0.3% growth. The annual rate of consumer price growth accelerated to 2.9% overall and remained at 3.1% in the core index, which excludes food and energy.

In this context, today’s CPI estimates appear to be well within expectations. After the initial surge in the dollar, driven by high-frequency robots processing headlines, the market nevertheless moved towards selling the USD, based on the assumption that PPI dynamics would soon shift to CPI, i.e. that inflation would slow down. At the very least, today’s data does not overshadow the importance of the weak labour market indicators we learned about last Friday.

Another worrying labour market indicator is the surge in weekly jobless claims to 263,000, the highest in almost four years. Such data will likely finally switch the Fed into a mode of consistent rate cuts in an attempt to keep the economy from falling into recession. This is bad news for the dollar, but at this stage, it is quite good for stocks, as there have been no signs of a noticeable decline in consumption so far, only caution due to tariff uncertainty.

The FxPro Analyst Team