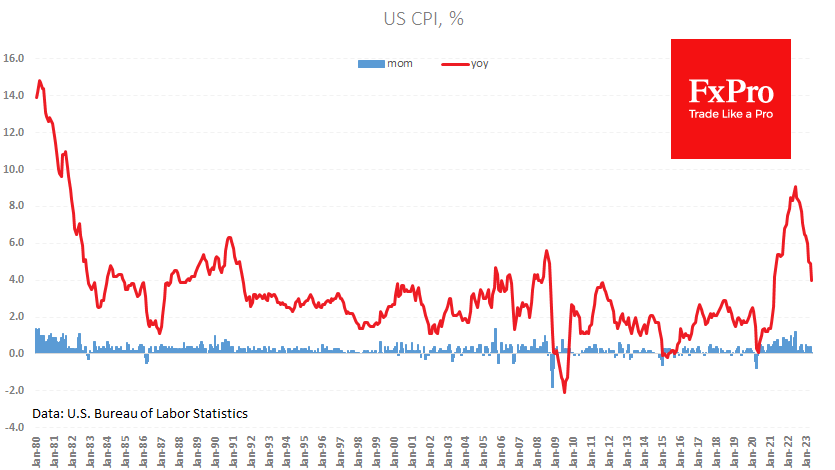

US consumer inflation slowed to 4.0% y/y in May from 4.9% y/y. The monthly gain was 0.1%. In both cases, the data was 0.1 percentage point weaker than expected, marking a slightly faster decline in the inflation problem than expected.

By and large, inflation has returned to normal due to energy and food, which are not only no longer contributing positively to price increases but are pulling them down.

The core CPI (excluding food and energy) added 5.3% y/y against 5.5% y/y. However, there is an elevated pace of month-on-month price growth, which could soon be a stumbling block for the markets.

So far, rate rises have not caused enough of a cooling of the economy and labour market that this would reduce domestic price pressures. The current monthly rate of increase of the core index has been observed in the second half of the 1980s, bringing the overall inflation rate to around 4%, which is half the peak but twice the target.

On the other hand, given the lag effect in monetary policy, the Fed may still announce a “monetary regime change”, i.e., a signal that rates have peaked, and easing will follow a pause, the duration of which will be determined by economic data.

On the balance sheet, we have a contradictory inflation report, and it will be up to the Fed to determine the further direction of the stock indices and the dollar at tomorrow’s meeting.

The FxPro Analyst Team