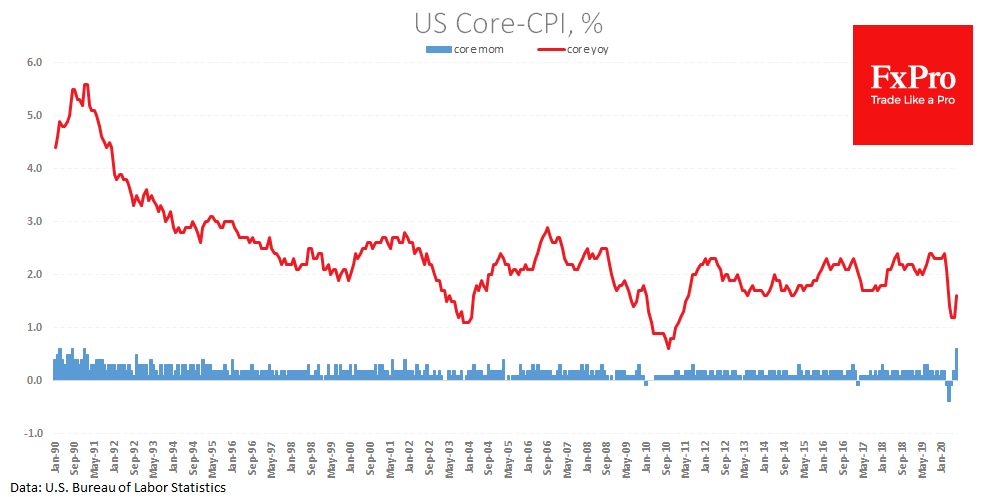

A new piece of data on the rise in inflation has been released, this time from the USA, where CPI rose 0.6% in July and again beat forecasts. The Core-CPI also jumped by 0.6% for the month, the strongest monthly jump since Jan 1991. The roots of the growth can be seen in disrupted supply chains and stimulus for households.

As the US policymakers discuss new measures, further acceleration of inflation is well on the way. Potentially, this is a threat to the bond market.

Already, there is a trend of increasing yields of 10-year government bonds. At the beginning of August, their yield sank to 0.5% but is already approaching 0.7%. This is not the first such reversal this year.

In March, the steady growth of the UST yield coincided with a sharp reversal of the dollar towards growth. In the first five days of June, the growth of UST-10 did not stop the decline of the dollar. What will become of it this time may become clear in the next few days.

The FxPro Analyst Team