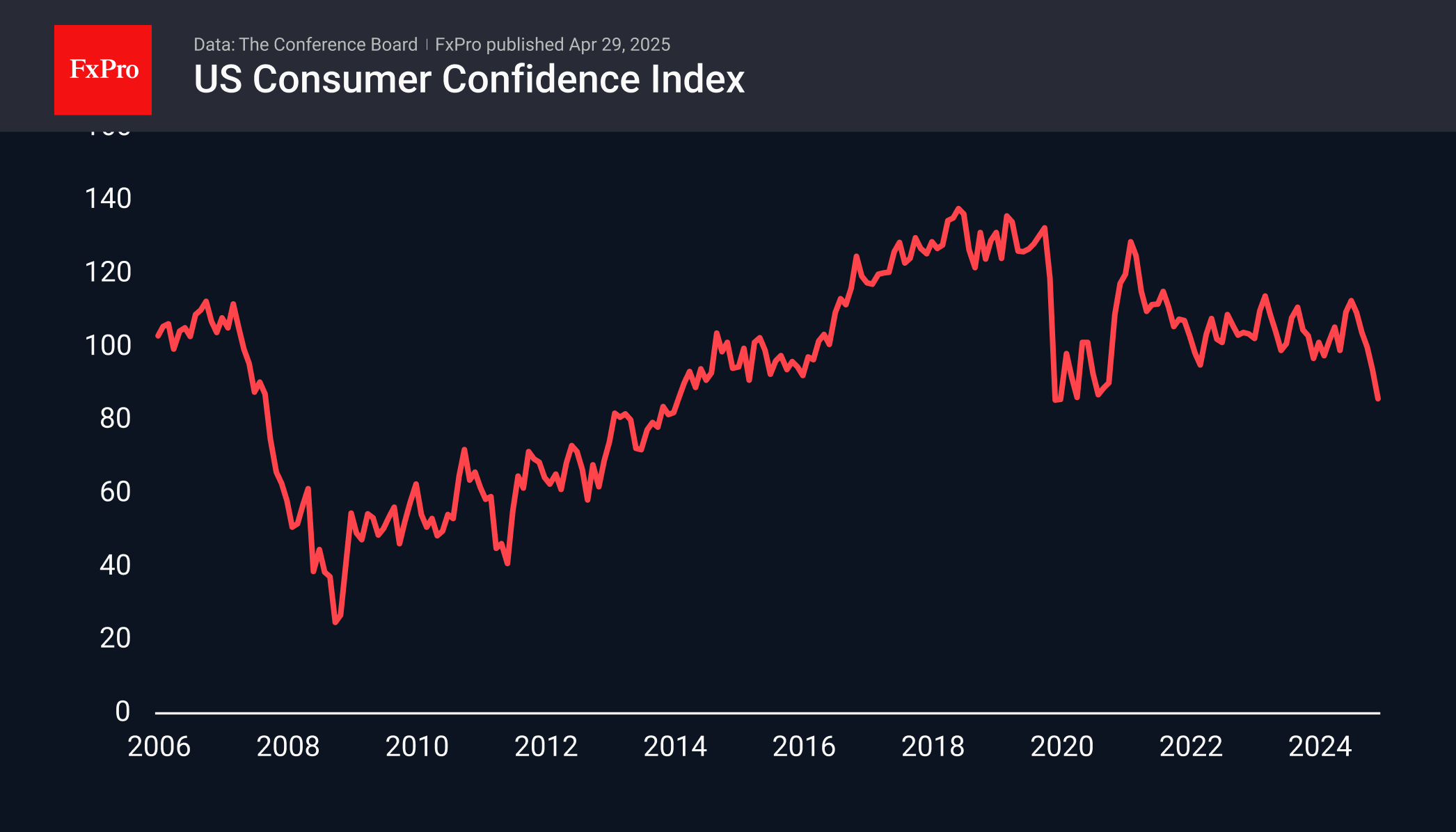

Consumer confidence in the US is declining, particularly regarding future prospects. The overall consumer confidence index published by the Conference Board fell to 86.0, recording its lowest reading since May 2020. Barring covid shocks, the last time the index was this low was in 2014.

The picture is even bleaker for the expectations component, which fell to its lowest level in 13 years. By May, this index had rolled back to 54.4, while a dip below 80 is considered a harbinger of recession.

This is negative news for the dollar in the medium term. Falling consumer confidence is an important warning signal to businesses that a decline in sales is coming next. In the US, where final consumption accounts for about 80% of the economy, this promises to translate very quickly into a reversal in the labour market. The first significant signs of this shift could emerge as early as the end of this week.

In turn, this will be a good reason for the Fed to cut rates. If this whole story plays out without shocks to the financial markets, it will leave the dollar on a downward path. However, in an extreme scenario, a sell-off of riskier assets, such as stocks, commodities, and the debt securities of smaller economies, could trigger a surge in demand for the USD.

The FxPro Analyst Team