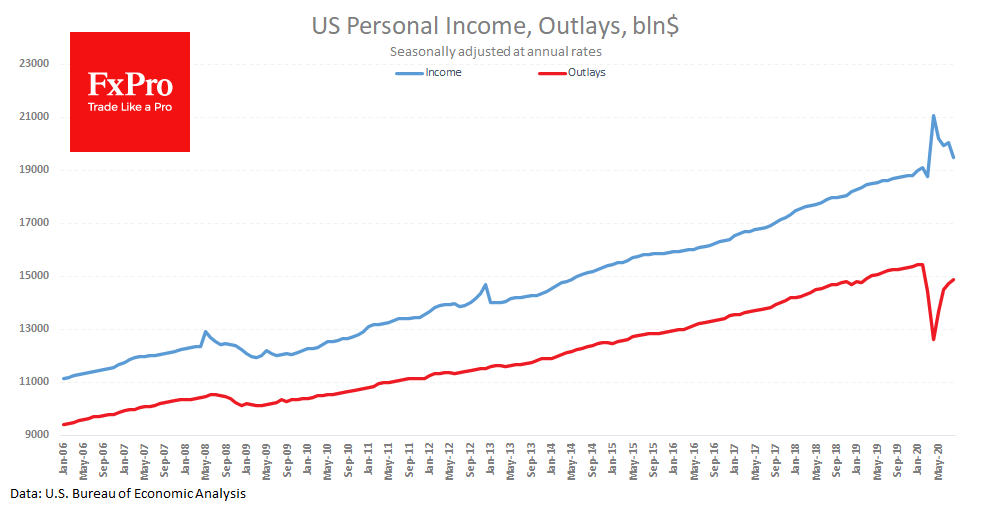

Monthly US personal income and outlays figures are converging, but savings are still high. Income fell by 2.7% in August to an annual level of $19.49 trillion, roughly the same as the trend amounts we could have seen had it not been for the pandemic. The government support measures earlier this year made up for the shortfall one could have expected with an additional 10 million unemployed.

However, outlays indicate that consumers have not returned to their previous lifestyles yet. In August, they rose by 1.0%, but that is still 3.7% below the February level. Americans are still saving more than usual, with a saving rate of 14.1% in August. During the six months of the pandemic, Americans have put aside three times more money as in the same period last year, mostly due to spending cutbacks.

This could have been good news for the stock market and the housing market, where part of these savings is heading. However, we must not forget that spending is driving the American economy. Without it, it is doomed to be cut back, and this is an alarming situation.

The FxPro Analyst Team