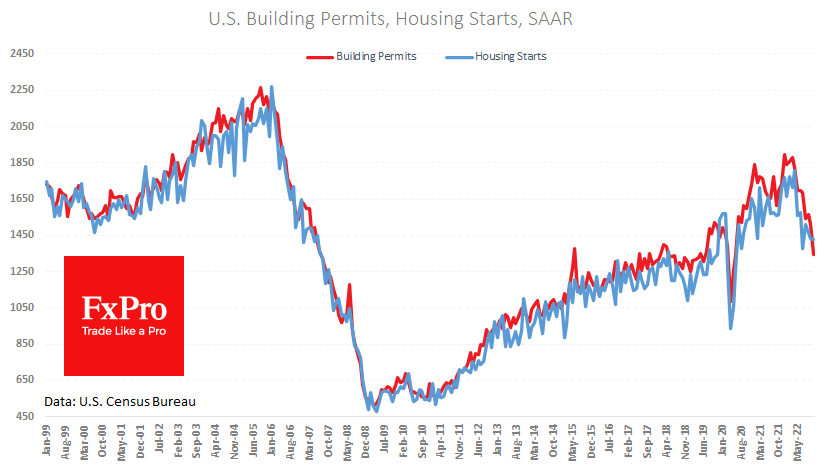

The number of US building permits issued collapsed by 11.2% in November to 1,342K after falling by 3.3% a month earlier. Barring a dip in the pandemic, this low number of permits was mid-2019 when the Fed turned to cut rates to support waning economic growth.

The biggest thing the Fed can do in the coming months is to slow the rate hikes and hope for a pause in the hike in a quarter or two.

The number of housing starts fell by 0.5% following declines of 2.1% and 2.9% in the previous two months. The decline is not so steep here, but a clear downward trend is still in place.

The rate of decline in construction is now comparable to what we have seen since 2005. On the other hand, overall construction volumes are near 2017-2019 levels, which can be considered an essential watershed between a desired economic slowdown and an uncontrolled collapse.

The cooling in housing real estate could be confirmed or denied in tomorrow’s secondary home sales publication, where a second consecutive decline of more than 5% and a tenth consecutive month of decline are expected. Housing market weakness is terrible news for the dollar as it revives speculation that the Fed will stop hiking or reverse to lower rates sooner than the FOMC is currently forecasting.

The FxPro Analyst Team