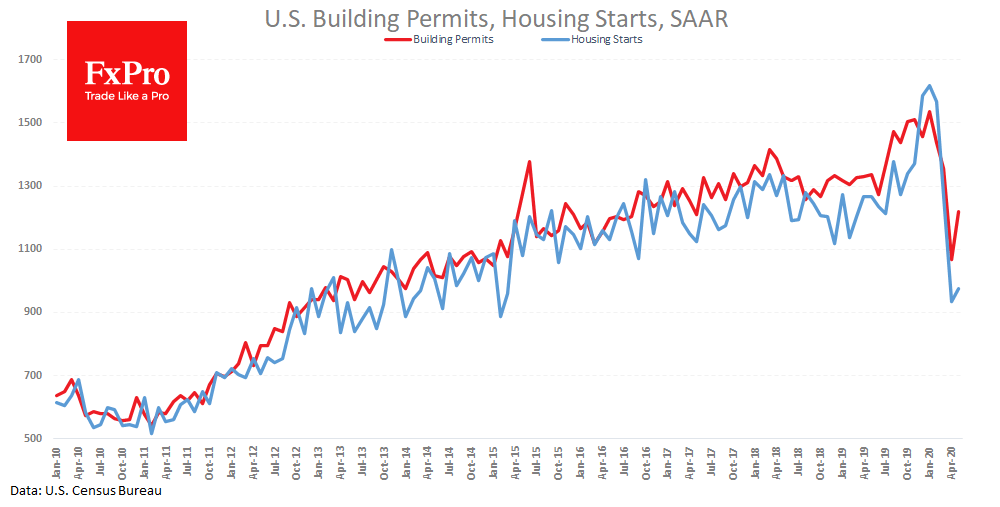

US construction activity recovered in May, although it turned out to be weaker than expected. The number of building permits issued last month grew by 14.4% mom (expected +16.8%) to an annualized level of 1.22M. This level is approximately 14% lower than the average level for 12 months to February 2020, before the coronavirus hit the economy. Building permits, although below expectations, still marks a very vigorous rebound from the bottom.

Things are much worse with the Housing Started. In May, the increase was only 4.3% after a collapse of 26.4% a month and expected 23.5% rebound. This indicator last month remained near 5-year lows.

After a slight increase in industrial production, today’s house starts rates acts as new evidence of the challenging recovery in business activity after the lockdown and may be due to a disruption in the supply chains.

The FxPro Analyst Team