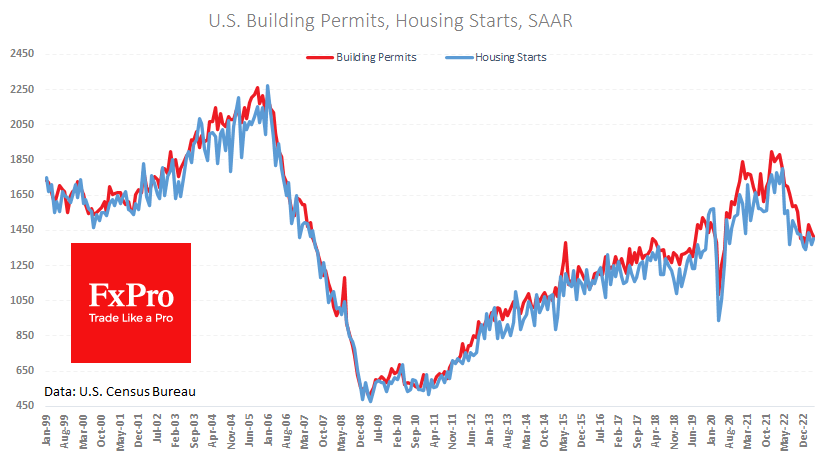

The US housing market continues to bear the brunt of high-interest rates. The number of building permits issued fell by 1.5% in April, following a 3.0% decline a month earlier. The last two months of decline erased almost half of the February surge, raising the chances that the housing market has yet to reach its lowest point in this cycle.

Nevertheless, the rate of decline in new construction in the USA has slowed since the start of this year. However, throughout 2022, the decline has been comparable to what we have seen since early 2006, which turned into a global financial crisis.

While the decline in construction by about a quarter of the peak looks frightening, it should be noted that similar volumes were seen between 2017 and 2019. Afterwards, we have seen everything from a shock freeze due to total lockdowns to a boom due to unprecedented stimulus.

The FxPro Analyst Team