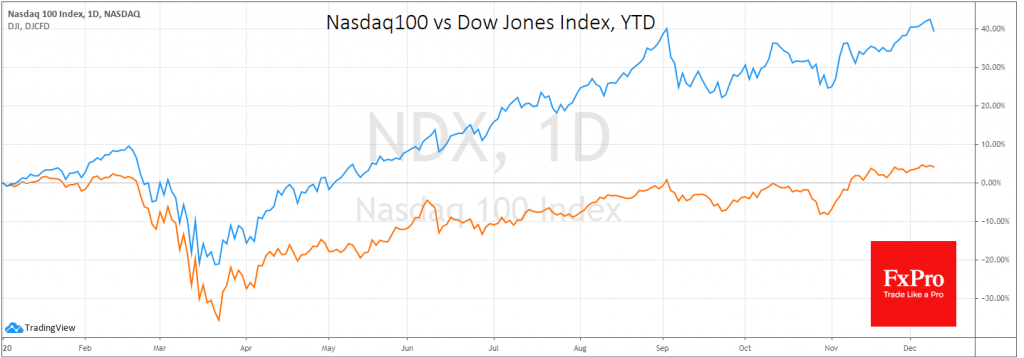

The Nasdaq100 index lost about 2% on Wednesday, spreading doubt in Asian markets on Thursday morning. The decline in Nasdaq was triggered by an antitrust lawsuit against Facebook, as well as a 6% decline in Tesla shares after news of an additional $5 billion stock issue. The downside of the fact that just a few names have pulled the entire market up in previous months is the index’s vulnerability to the recent deterioration of several star companies.

While Nasdaq has been hit hard, giving up its growth from the month so far, DowJones remains slightly above 30,000, avoiding sharp movements since early December.

Separately, US lawmakers have not been able to overcome differences regarding the aid package. This news also triggered a wave of profit-taking for equities, as markets have been quick to price in negotiation progress.

In the last few weeks, Cable was pushed up on high hopes of progress in the Brexit negotiations, but as talks stalled the pound fell. Once again, participants postponed the signing, this time until the end of the week. This news caused the failure of GBPUSD in the morning to 1.33, and it is now traded at 1.3350. For the last two and a half years, the pair has not been able to trade solidly above 1.35, as heavy divorce negotiations with the EU are pushing the pair down from the upper bound of the trading range.

The single currency is carefully adjusting its gains against the dollar earlier this month. EURUSD slid under 1.21 in anticipation of the ECB monetary policy decision and comments. Investors and traders, as in all cases above, have priced in very optimistic hopes for stimulus, suggesting that we will see an expansion of the QE and a new round of lending for banks.

Traders are also waiting with interest to see whether ECB President Lagarde will comment on the 14% growth of the euro against the dollar over the last nine months. Concerns about the strengthening exchange rate may reinforce short-term corrective sentiment in EURUSD.

However, investors may be overly optimistic about the willingness of the ECB to act quickly and decisively. The relative sluggishness of European politicians promises to delay the recovery. However, this may translate into a new growth momentum for the euro.

As with Brexit and the aid package in the USA, the lobbying process may push the single currency further up from the bottom of the trading range 1.2000-1.2500. But all this bureaucracy and political games are hurting stock markets, and the appreciation of the euro could further increase the impact on European assets.

The FxPro Analyst Team