Recent reports from Europe and the US have highlighted a slowdown in inflation. The slowdown in price growth triggered a wave of purchases of risk assets in the hope that central banks would not have to keep rates at restrictive levels for too long.

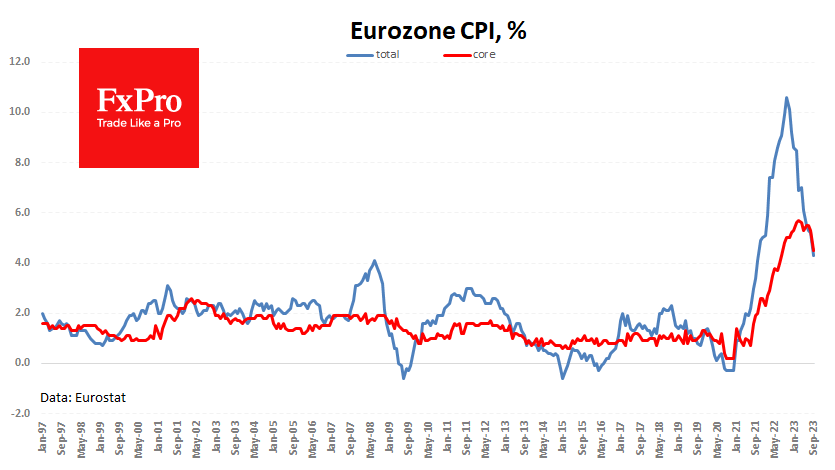

In the eurozone, overall inflation in September decreased from 5.2% to 4.3% y/y, and Core PCE slowed from 5.3% to 4.5%. In both cases, the data is below expectations. And this immediately revitalised expectations that the ECB would no longer need to raise rates. Expectations of looser monetary conditions are favourable for the stock market. Ironically, it also supports the euro’s rise, directly correlating with stock indices.

The US released its estimate of personal income and spending. The Fed focuses specifically on the price deflator from this report as it estimates a much broader consumer basket. The price deflator, excluding food and energy, fell to 3.9% y/y, the lowest over two years. The overall price deflator accelerated slightly to 3.5% from 3.4% a month earlier.

Despite this slowdown, Americans are saving less and less. The savings rate fell to 3.9% in August, a new low this year. Also visible is how income growth has stalled in recent months while spending is creeping up. By April, spending had risen 2.2% and disposable income 0.8%.

The FxPro Analyst Team