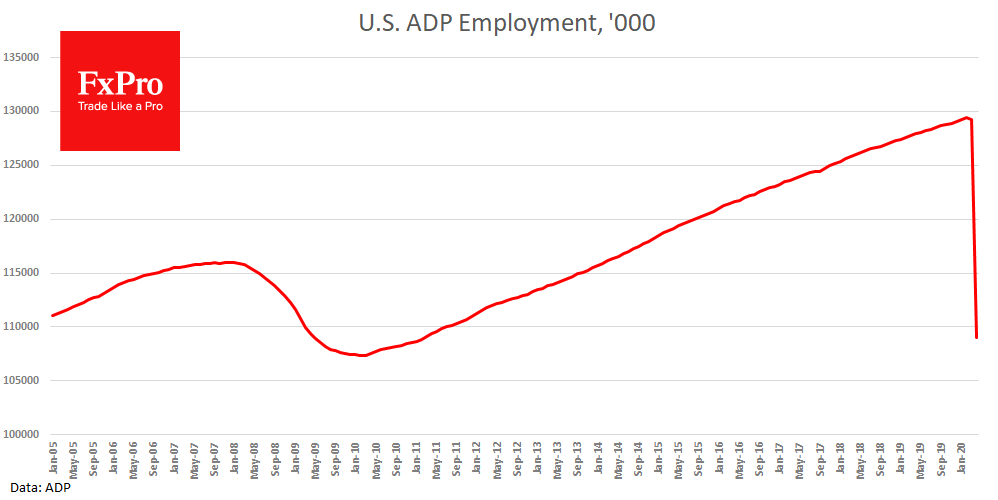

ADP reported a drop in US employment by 20,236K or more than 20 million in April. This luck or the skill of market analysts, but the average forecasts of a decline of -20.5 million were incredibly close to the actual data. Statistics from ADP are published two days before the official report, often being a good reference point for the markets. The number of people employed in the private sector fell to 109 million, which is the lowest since March 2011.

Dramatic fall of employment is terrible news for the United States, which could worsen the perception of stock market participants about both the depth of the recession and its long-term consequences. However, the dollar can not only resist but also strengthen subsequently. If data on the labour market cause a massive sale of risky assets, capital will flow into the liquid and more reliable US Treasury bills and bonds. Concerns over weak European data and the integrity of the eurozone can further stimulate interest in the dollar.

The FxPro Analyst Team