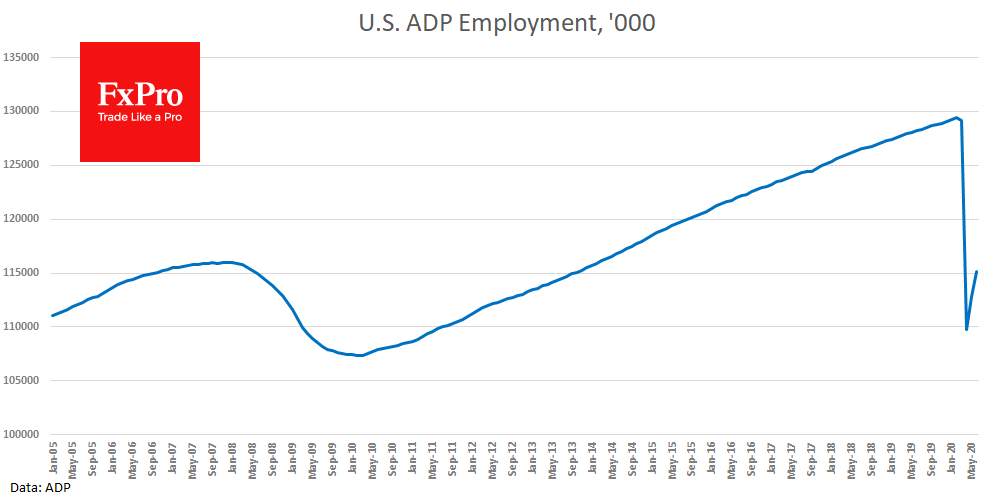

ADP’s monthly labour market report noted US private sector employment growth of 2.37 million versus 3.07 a month earlier and close to the expected 2.85 million. The total number of employed in the private sector is 14.3 million lower than February levels. However, employment recovery is also coming in conjunction with other strong economic releases today. Markit and ISM PMI estimate exceeded expectations, noting entry into growth territory in June for many major indicators.

All this spurred the interest of market participants in risky assets: US stock indices resumed growth, and the dollar was under severe pressure, losing 0.8% to the euro to 1.1270. An additional sign of returning appetite for markets was the sale of gold, the price of an ounce fell by $27 to $1762 after in a matter of hours after an unsuccessful attempt to jump above 1790 earlier today.

Interestingly, markets are ignoring alarming data on the spread of coronavirus in the United States. We have already seen something similar earlier this year, and a sharp return to reality then caused the most acute correction of markets in modern times. It is not known, whether this situation will happen again as US lawmakers are desperately resisting the idea of restoring the full lockdown for the second time, as they were in March-May.

The FxPro Analyst Team