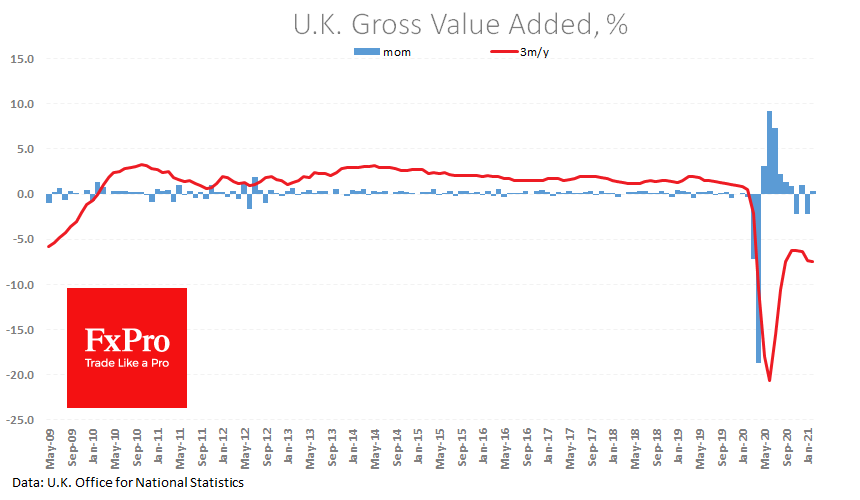

Predominantly positive macroeconomic data for February from Britain supports the recovery of the British pound on Tuesday morning. The ONS reported that the economy added 0.4% after contracting by 2.2% in January. Industrial production added 1%, twice as much as expected.

The construction sector is booming even more, posting a 1.6% growth in the month under review, triple the expectations and steadily narrowing the dip to last year.

The service sector is still a drag on the economy, adding only 0.2% in February. The planned easing of restrictions in the coming weeks should soon turn the service sector into a booster for recovery rather than a hindrance.

Relatively strong data might help the Pound gain support after its slump against the Dollar below 1.37 at the end of last week. Potentially, by the end of this week, GBPUSD could consolidate near 1.3850. A further rise would suggest a recovery of the British currency’s bullish rally after a pullback since late February.

The FxPro Analyst Team