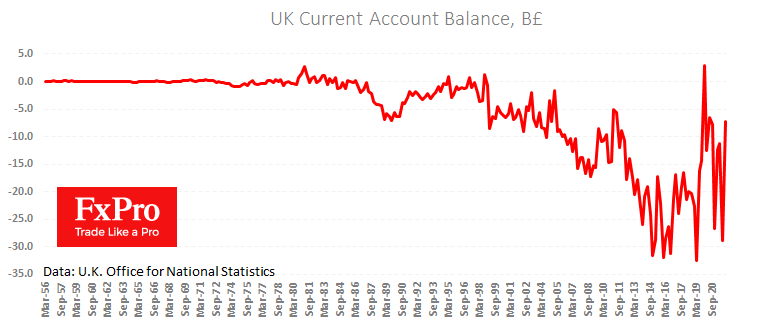

On Thursday morning, another pack of upbeat statistics from the UK supports the British pound. Final GDP data for the fourth quarter showed a gain of 1.3%, revised up from the previous estimate of 1.0%. The balance of payments deficit at 7.3 bln was the lowest in 11 years.

Separately, Nationwide reported that the price of houses rose 1.1% YoY in March and accelerated to 14.3% YoY, the fastest pace since 2004. This is another factor favouring the Bank of England’s stance on tightening monetary policy to prevent the credit bubble and curb inflation from spiralling further out of control.

Such data suggests less outflow of currency from the country and points to solid fundamentals in the economy to withstand further monetary policy tightening to combat inflation, which is positive for GBP. Earlier, the Bank of England showed that it could implement policy tightening ahead of the US Fed, which is positive for the GBPUSD and suggests the potential for a sustained reversal of the pair to long-term growth.

The technical picture is also on the bullish side. GBPUSD has corrected around 40% of the rally from the lows at the start of the pandemic from May 2021 to March 2022, which fits into the Fibonacci retracement. Resilience at current levels opens up the potential for further long-term strengthening to 1.6000.

The FxPro Analyst Team