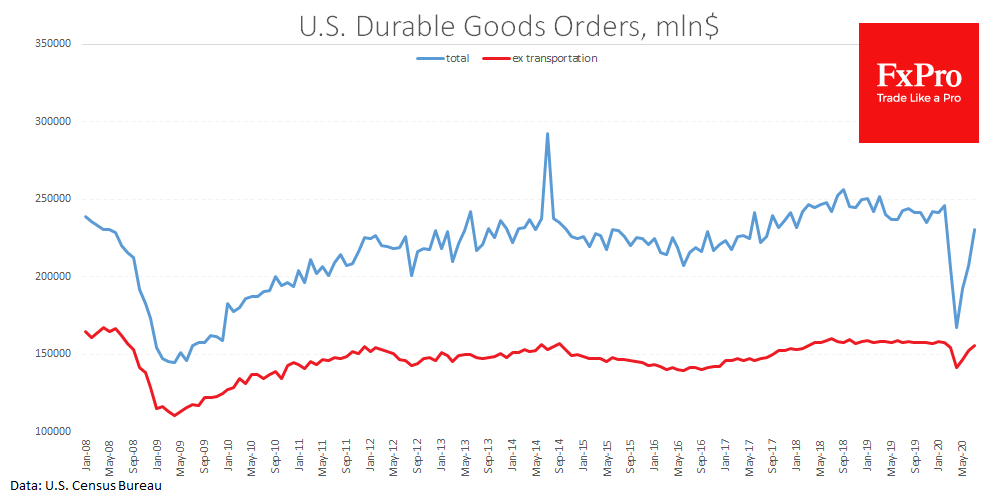

Orders for durable goods in the US significantly exceeded expectations in July. The latest Census Bureau report showed an 11.2% jump last month vs 7.7% a month earlier and 4.4% expected.

The increase in orders over the last three months has brought them back to just 6% below February’s peak. Orders excluding transportation are only 1% below February’s level, which is a strong signal of recovery in business demand.

Except for the disappointing drop in consumer confidence yesterday, recent economic data from the US has mainly exceeded expectations, raising the Citi Economic surprise Index to a historical high and explaining the market’s traction.

Besides, increasingly positive data supports the dollar: GBPUSD slipped to 1.3110, and EURUSD fell below 1.1800 after the publication of the Durable Goods Orders Report.

The FxPro Analyst Team