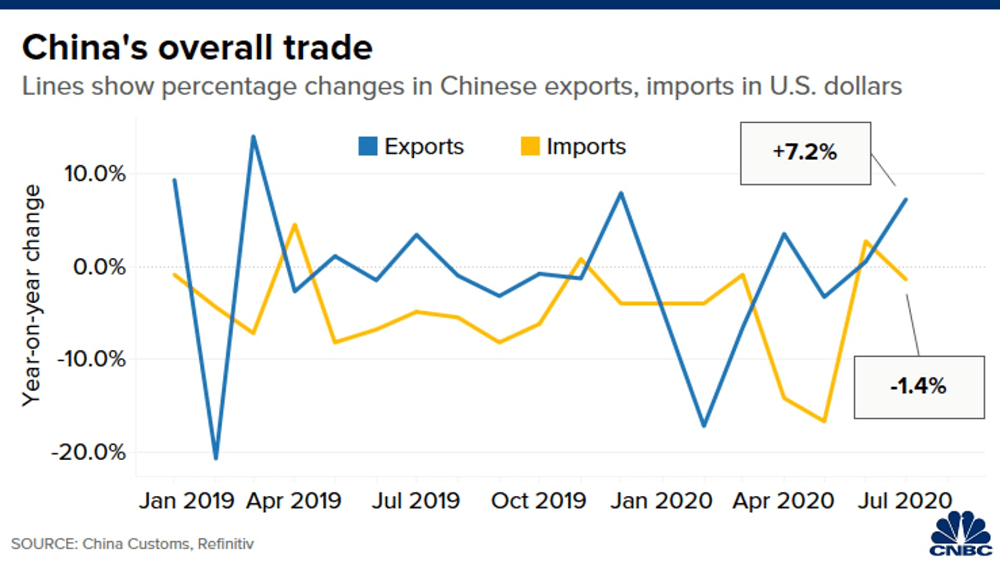

China’s dollar-denominated exports rose 7.2% while imports fell 1.4% from a year ago, data from the country’s General Administration of Customs showed on Friday. Economists polled by Reuters had expected China’s dollar-denominated exports to fall by 0.2% from a year ago, while imports were predicted to have risen 1% from a year ago.

In June, China’s dollar-denominated exports posted a rise of 0.5% compared to a year ago, and imports rose 2.7% in the same period. In July, China posted a trade surplus of $62.33 billion, beating the $42 billion economists had expected. China’s trade surplus was $46.42 billion in June. Despite the coronavirus pandemic hitting global demand, exports from China have held up as exports in medical supplies jumped in the first half of the year. The trend persisted into July, noted Martin Rasmussen, China economist at Capital Economics.

Senior officials from both countries are reportedly planning to review the implementation of their “phase one” trade deal next week. Next week’s meeting will likely be “really challenging,” said Ronald Wan, non-executive chairman at Partners Financial Holdings in Hong Kong. China’s overall demand has been dragged down by the pandemic, making it hard for the country to fulfill its purchase promises in the phase one trade deal, Wan told CNBC’s “Street Signs.” Beijing is also focusing on an “internal economic cycle” with production and consumption taking place in the country itself. This signals that the Chinese government doesn’t expect a really positive outcome from the trade talks, according to Wan.

China’s exports rose 7.2% on-year in July due to demand for medical supplies, CNBC, Aug 7