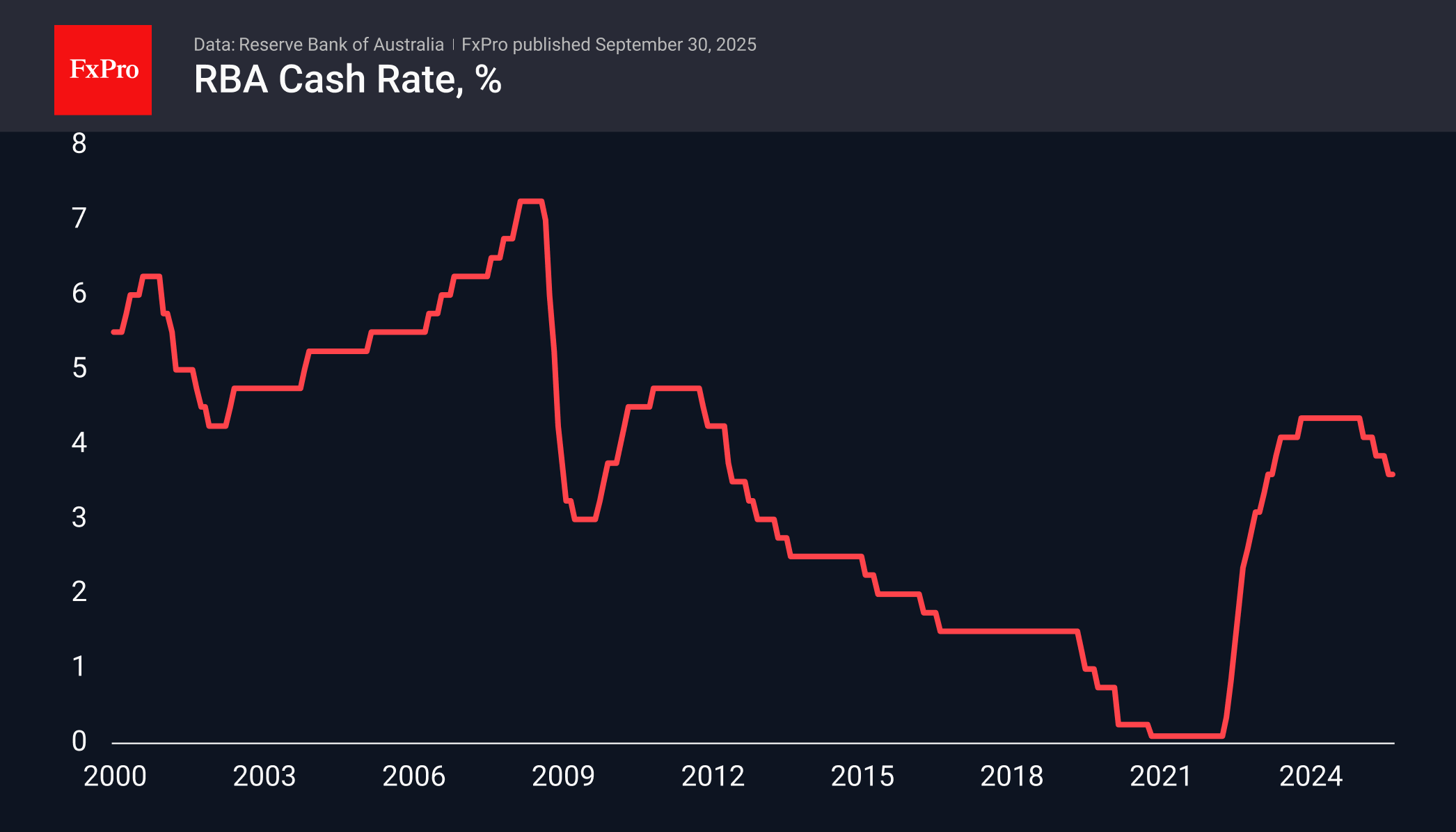

The Australian dollar gained for the third trading session, accelerating its growth to 0.5% on Tuesday after the Reserve Bank of Australia decided to keep its key rate at 3.60%. Analysts widely anticipated the decision, but the official commentary on the decision contained hawkish notes, which played into the hands of the AUD.

The RBA noted that September inflation may be higher than previously expected and pointed to a recovery in economic activity. When the economy does not require emergency support and inflation is likely to pick up, central banks are more inclined to pause and assess the dynamic. In contrast, there are increasing signs in the US that monetary policy needs to be eased.

Taken together, this creates a divergence between Australian and US monetary policy in favour of the Australian dollar.

At the end of last week, AUDUSD found support at the 50-day moving average and reversed to growth at the 200-day average. The pair has been moving upwards within a range since the beginning of the year, from which it only fell during the shock of ‘America’s Liberation Day’ in early April.

The Aussie touched the upper limit of this channel on 17 September, briefly exceeding 0.6700, but the looming US government shutdown halted the strengthening of the USD on the Fed’s cautious comments. This exceptionally short-term and speculative story (a compromise was always found sooner or later) nevertheless undermines long-term confidence in the dollar, preventing it from reversing the downward trend that began at the start of the year.

The FxPro Analyst Team