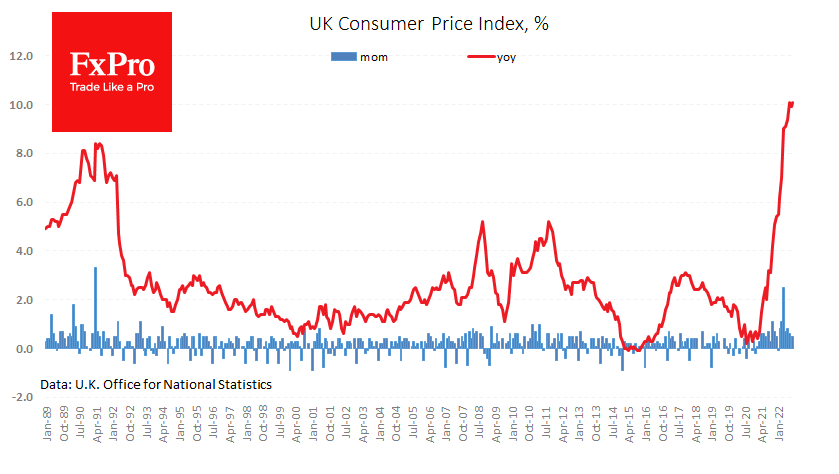

The portion of the UK inflation data showed that the problem is in no hurry to recede. The consumer price index returned to 10.1% y/y, changing hopes that the trend had already reversed. The retail price index is climbing further upwards, reaching 12.6%. The contribution of food to inflation has already exceeded the impact of transport costs.

Excluding these volatile components, the acceleration continues, with the core CPI rising to 6.5% compared to 6.3% the previous month. UK’s Retail Price Index at 12.6% y/y was last seen in March 1981. However, producer prices signal an easing of inflationary pressures, albeit not as quickly as previously hoped.

Input PPI has slowed to 20% from 20.9% a month earlier and peaked at 24.2% in June. Output PPI inflation slowed to 15.9% after peaking at 17% in July. The persistent downward trend in exchange prices for agricultural and energy products has reinforced disinflationary trends all these months.

The higher inflation trajectory is creating pressure on the Bank of England to take even more steps to raise rates. The Bank of England’s recent statements about its willingness to move to quantitative tightening from November and its reluctance to stretch out its emergency government bond-buying programme show that the central bank is indeed concerned about inflationary pressures.

The FxPro Analyst Team