Ukraine, Russia and Venezuela are the top three countries for cryptocurrency adoption, Chainalysis said in its Global Cryptocurrency Adoption Index, published Tuesday as a part of the firm’s upcoming report on global trends in crypto usage. The U.S. and China are still delivering the largest transaction volumes, but putting aside the largest “whale” crypto holders, Ukrainians, Russians and Venezuelans are the most active retail users of digital currencies, according to Chainalysis’ ranking. They are followed by China, Kenya and the U.S.

Chainalysis measured crypto adoption using on-chain cryptocurrency value received by a country, on-chain value transferred, number of on-chain cryptocurrency deposits and peer-to-peer exchange trade volume. The data was weighted by the purchasing power parity per capita and number of internet users in each country.

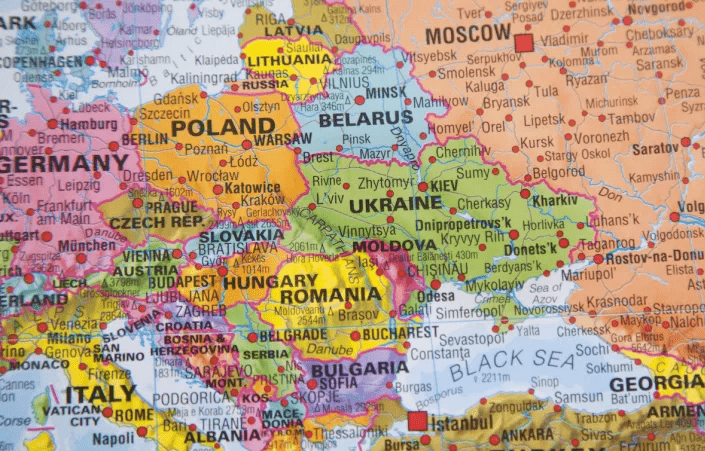

Out of the three nations, Ukraine may be the most surprising leader because the country largely flies under the radar of the global crypto community. Located in Eastern Europe and with a population of 42 million, the nation has both an unstable economy and tech-savvy citizens, which apparently is a good recipe for crypto use.

Retail investors are interested in crypto as there are not many other options for savings and passive income in Ukraine. The economy is small and there is no national stock market. Banks often fail and investing in real estate is too expensive for most people. Crypto, on the other hand, has a low barrier to entry, easier compliance requirements and is safer than just holding onto cash.

Crypto, like U.S. dollars, is a hedge against the volatility of the national currency, Ukrainian hryvnia, and against the general instability of Ukraine’s political and economic situation, said Ukrainian Bitcoin Core developer Hennadii Stepanov, going by hebasto.

Quantifying crypto activity by country gets tricky, as individual bitcoin wallets aren’t marked with geographical locations. Chainalysis admits that geographic data is hard to get right if you only look at on-chain transactions, so the firm requested data directly from the global P2P trading platforms, namely LocalBitcoins and Paxful, and talked to experts on the ground, Grauer said.

To see activity in particular countries, Chainalysis mostly looked at web traffic on the crypto trading, merchant, gambling and other services using SimilarWeb, Grauer explained. If that data was not available, transaction data was analyzed using time zones, most popular fiat currency pairs, language options used and the location of the headquarters of the services.

Ukraine Leads Global Crypto Adoption, Chainalysis Says in New Report, CoinDesk, Sep 9