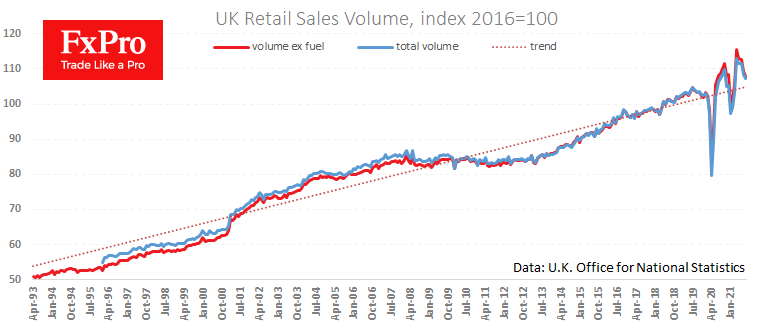

UK retail sales collapsed by 0.9% in August, an unpleasant surprise against a 0.5% rise expected. The retail sales index is above pre-pandemic peaks, but the markets should be alarmed by the volatility of the data.

Weak retail activity figures could push back the Bank of England’s plans to normalise policy.

Sales were virtually unchanged from the same month a year earlier. Sales excluding fuel are 0.9% lower. And this contrasts sharply with the US figures with a 14.9% and 14.3% rise, respectively. Such a contrast has the potential to put more pressure on the pound against the dollar.

GBPUSD has failed to stay above 1.38 this month. A batch of weak data from the UK and encouraging US figures could give momentum for the pound to weaken in the coming days, opening the way to 1.36 by the middle of next week, FOMC monetary policy decision.

If the US Central Bank confirms a hawkish attitude, a downward momentum to 1.30-1.32 could form in GBPUSD. EURGBP has been feeling clear support on the dips to 0.8500 in recent days, and it promises to strengthen in the near term.

The FxPro Analyst Team