UK credit and money supply data published on Wednesday mostly came out weaker than expected, indicating a continued tightening of financial conditions. The unexpected exception was the number of approved mortgage applications.

The M4 unit shrank by 0.4% m/m, contrary to forecasts of a 0.9% growth. By last year, growth slowed to 1.0% – close to the cyclical lows of late 2018. The continued slowdown in lending is not particularly surprising. The net increase in lending in February was 2.1bn, which has fallen almost continuously since last August under pressure from rising interest rates.

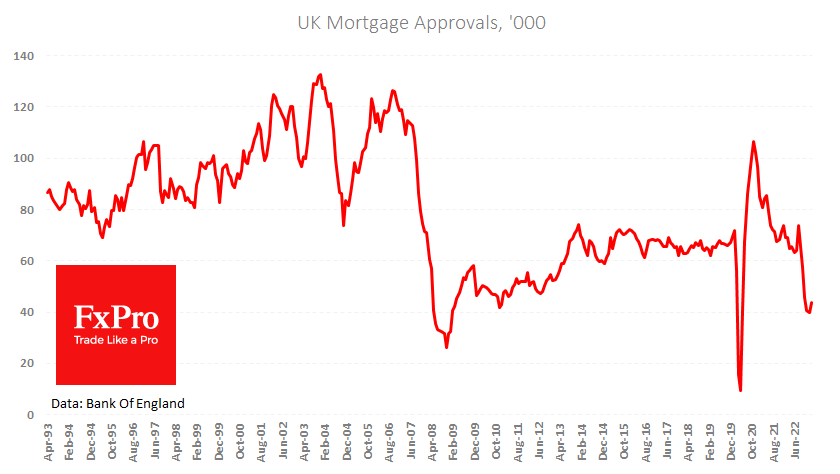

What is surprising is the rebound in the mortgage market. Banks approved 43.5K applications last month, up from 39.6K and 40.5K in the previous couple of months. Local approvals peaked in August when their number exceeded 73.5K. The current data is encouraging, as similar sharp reversals have been harbingers of a general trend reversal over the last twenty years.

The UK housing market has a noticeable impact on investor sentiment towards the Pound, and reversals of the former to growth have been closely associated with a rebound in GBP.

Earlier in March, the GBPUSD successfully defended the bullish uptrend for a second time, holding above the 200-day moving average and quickly returning to territory above $1.2000. Before that, the pair experienced a similar pullback in December.

In addition to the unexpected upturn in mortgage activity, investors should also look for a sustained rise in inflation. These reports pressure the Bank of England to tighten monetary policy. And this is good news for the British Pound, where interest rates and bond yields are lower than in the US.

For most of modern history, UK government bond yields have been higher than their US counterparts. This has changed in the zero-rate era. Last year appears to have ended that era, so it would not be surprising to see a return to the historical norm again. Inflation and housing market data so far support this idea.

If we are right, such a reassessment should return interest in the Pound in the foreign exchange market. GBPUSD is now trading at 1.2325, near the year’s highs and in line with the cyclical lows of 2016-2020. If the Pound resurfaces above this former support, a direct route to 1.35-1.40 will open up for it before the end of the year.

The FxPro Analyst Team