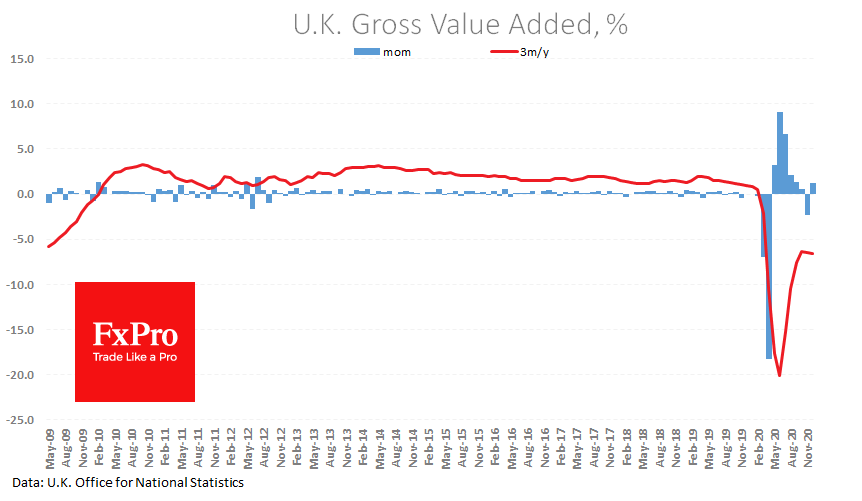

UK GDP data significantly exceeded expectations, but this is of little help to the pound after the release. At the end of the fourth quarter, GDP added 1%, twice as much as expected. The 9.9% fall in 2020 was the worst on record and did not allow the pound to strengthen amid a cautious trading pattern in global markets.

However, there are more positives in the report. The economy was adding in December despite record COVID-19 numbers. A separate report showed a 1.7% m/m growth in the service sector, the most vulnerable part of the economy during a lockdown. The massive vaccine roll-out in January and the continued vaccination rate offers hope for an accelerated economic recovery.

Due to Friday’s caution, the British pound reversed to a decline, falling below 1.38. That said, robust UK macro data will support the overall GBPUSD uptrend, with stronger buying likely to take place on a decline to 1.37 in the coming days.

The FxPro Analyst Team