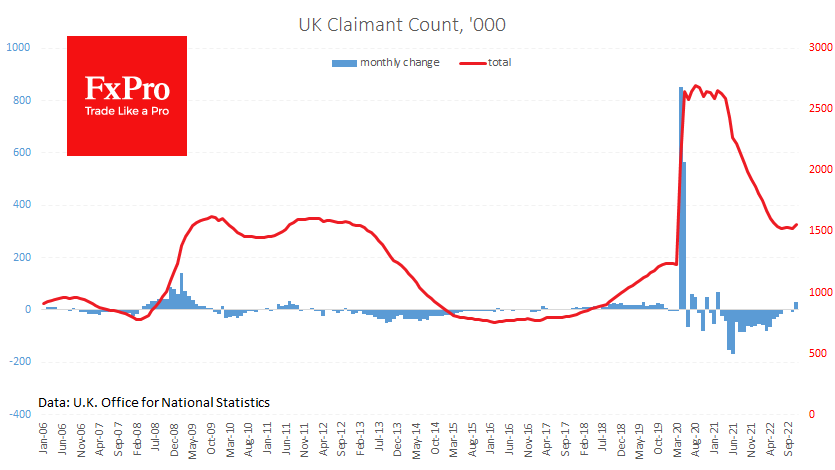

UK data released today marked a sharp rise in jobless claims, marking a turnaround in employment recovery after covid restrictions. The ONS reported a 30.5K increase in claimant count for November after a 6.5K decline a month earlier and a sharply stronger-than-expected 3.5K. Previously there had been a trend of slowing job growth over the months, but new jobs were still being created.

The labour market often acts as a leading indicator for the economy, overshadowing the positive surprise from the GDP data released the previous day. Interestingly, steady buying in the currency market has continued, with the pound rising against the dollar for the fifth consecutive trading session, testing the 1.23 level.

The rise in the pound is now mainly due to a reassessment of key rate expectations, where the market is raising the forecast terminal level of the key Bank Rate. This reassessment is linked to still building up inflationary pressures and the fact that the Bank of England focuses on this rather than labour market indicators.

However, in the medium term, investors should still consider the labour market’s weakness, as in Britain, this often quickly becomes a pressure in the real estate and services sector. If that is the case this time, too, the Bank of England will be quicker than currently expected to complete its policy tightening cycle and turn back to stimulative policy. We also note that the rise in unemployment caused by the economic problems of 2022 is well in line with the trend that started in 2016 and is likely to be linked to Brexit.

The FxPro Analyst Team