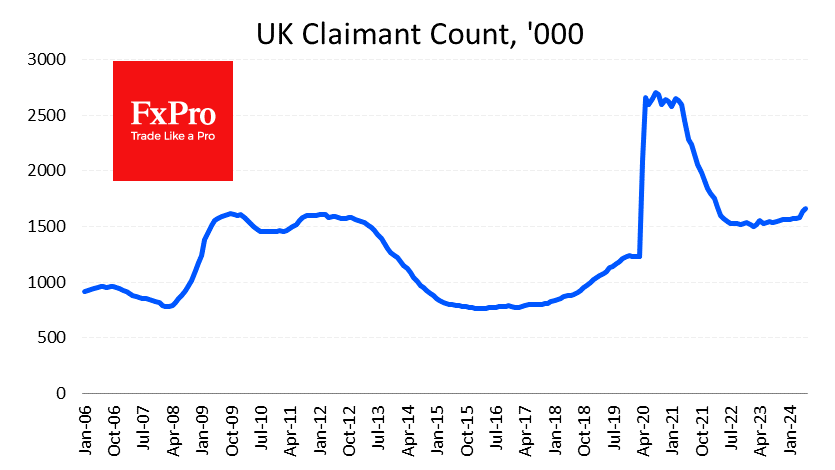

The UK labour market is experiencing a cooling phase. The number of applications for unemployment benefits in June increased by 32.3K after a jump of 51.9K a month earlier. Prior to that, this indicator had been drifting for almost two years, adding an average of 2.5K per month.

The rise in claimant count claims may be evidence of worsening economic conditions, strengthening the hand of inflation doves on the Bank of England’s Monetary Policy Committee. In this regard, weaker-than-expected data caused pressure on GBPUSD, forcing it to retreat to 1.2980 against the highs recorded at 1.3040 a day earlier.

In parallel, data recorded a slowdown in wage growth, with the rate of growth decelerating to 5.7% 3m/y. In earnings excluding bonuses, this is a pullback to levels we last saw in September 2022, but it is still significantly above the norm, suggesting continued impressive domestic pressure on prices.

On balance, the published data noted that the economy is moving in the direction needed for the Bank of England to ease policy but is unlikely to force this as early as August. With the data in hand, it seems that the Central Bank may wait until mid-September or even early November.

The FxPro Analyst Team