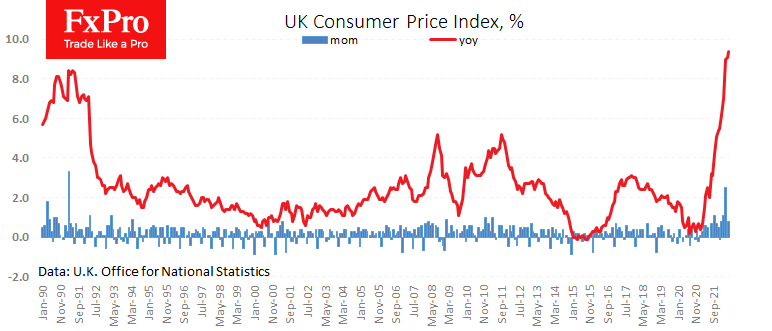

A fresh set of statistics from the UK showed that inflation is still not slowing down. The rate of consumer price growth climbed to 9.4% y/y in June after they added 0.8% for the month, four times the long-term average monthly increase of 0.2%.

But, even more worryingly, the leading inflation indicators do not cease to surprise. The Producer Purchasing Price Index added 1.8% in June against expectations of 1.2%, to 24% y/y. Producer Output Price Index rose by 1.4% (expected 1.0%), to 16.5% YoY.

A separate publication noted an acceleration in house price growth from 11.9% YoY to 12.8% in May.

Earlier, Bank of England officials spoke about the need to accelerate policy tightening to fight inflation. Fresh reports indicate that the Monetary Policy Committee will assess the need to raise the rate by 50bp or more in the next two weeks, moving away from the measured 25bp step.

While accelerating monetary policy normalisation has the potential to support the pound, this is bullish news for the stock market and overall risk demand. The pound is sensitive to fluctuations in risk appetite, so do not expect it to make a sustained return to growth against the dollar without a stock’s bull market first.

The FxPro Analyst Team