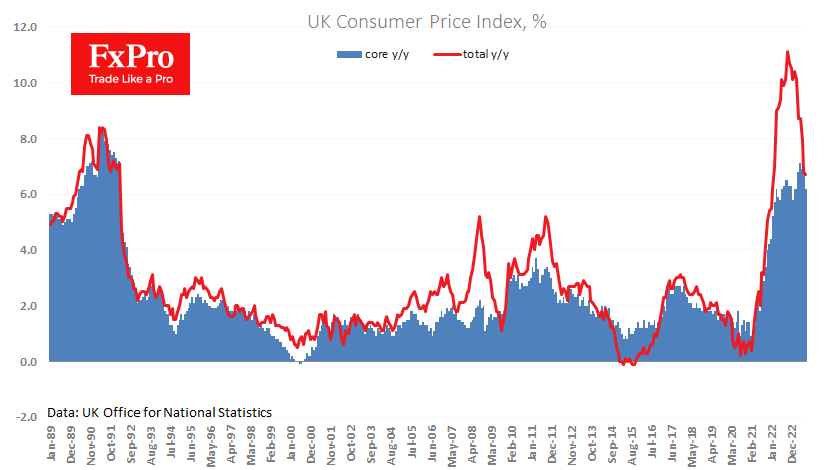

UK consumer inflation slowed from 6.8% to 6.7% y/y, contrary to the expected acceleration to 7.0%. Core inflation, excluding food and energy, saw an even more significant slowdown of 6.2% from 6.9% y/y, well below the average forecast of 6.8%.

The weaker-than-expected data sparked a brief sell-off in GBPUSD, with the exchange rate dropping nearly 0.5% within minutes to 1.2330, a level last seen in May.

The UK’s annual price growth rate is still higher than other developed economies, outpacing several major emerging ones. The latest data has fuelled speculation that the Bank of England will pause on rate hikes or even end the hiking cycle that began almost two years ago.

But the dovish rhetoric looks premature in our view. These 9.1% y/y retail price increases are unacceptable for a developed country, and core inflation has been “too high for too long”, entrenching inflation expectations. A strong labour market increases the risk of secondary inflationary effects, exacerbated by the recent rise in commodity and energy prices.

Producer input prices rose by 0.4% in August. Producer output prices have risen by 0.2% over the past two months, signalling the end of the deflationary impact on final inflation.

For over two months now, the Pound has been gently retreating against the Dollar because of contrasting economic data from these countries, with the UK being the weaker side. However, it would be a mistake to assume that the Bank of England will quickly turn its monetary policy towards easing, as this could increase pressure on Sterling and reinforce pro-inflationary factors.

The FxPro Analyst Team