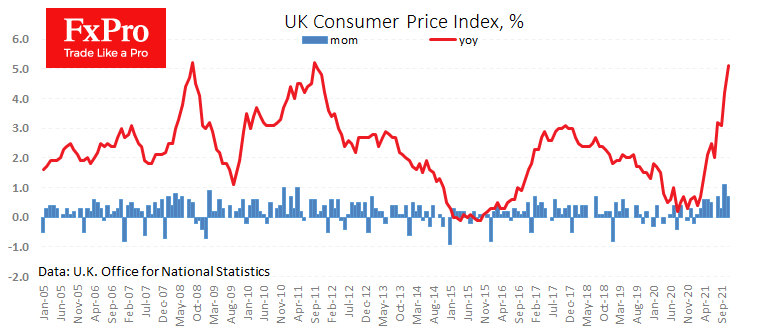

UK consumer inflation accelerated to 5.1% in November, coming close to turning peaks in 2008 and 2014 of 5.2%. Higher levels were last seen in Britain only in the early 1990s.

The figures exceeded economists’ average estimates of 4.8%. Overall, the entire inflation data package exceeded expectations, posting a 14.3% y/y rise in producer input prices. Producer selling prices show a 9.1% YoY increase.

Meanwhile, producers continue to pass the increased costs onto consumers to a large extent, as producer input prices added 1% for November, selling prices added 0.9%, and consumer prices added 0.7%.

Yesterday we saw employers broadly maintaining the pace of wage growth until October, indicating that the inflationary spiral continues to unwind. This is a significant signal for the Bank of England, which on Thursday could give a clear call of a rate hike early next year. And it’s good news for GBP, which gets support on the decline to 1.32 earlier this week.

The FxPro Analyst Team