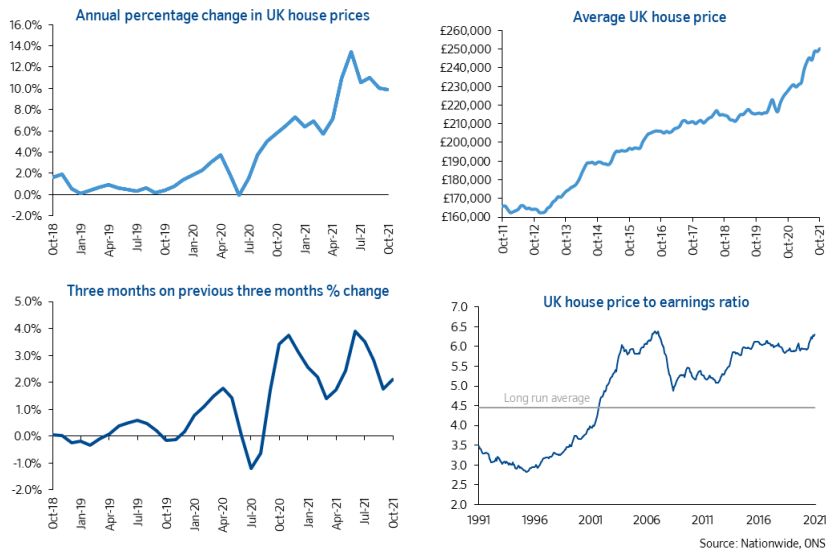

The annual growth rate in UK house prices fell to 9.9%, returning to the single-digit territory after five months. At the same time, a 0.7% jump in prices in October signalled increased buyer’s demand.

Buyer interest is based both on accelerating inflation (actual and felt considering the jump in energy prices), which lowers the value of money, as well as a desire to lock in the current low mortgage interest rate. Financial markets are banking on a 0.15 percentage point rate hike by the Bank of England as early as tomorrow.

Yields on 10-year government bonds have doubled since August. Although long-term interest rates remain broadly in a multi-year bearish cycle, Britons generally follow Ray Dalio’s strategy of preferring to borrow in the current macroeconomic process, betting that inflation will eat away at the purchasing power of money.

The FxPro Analyst Team