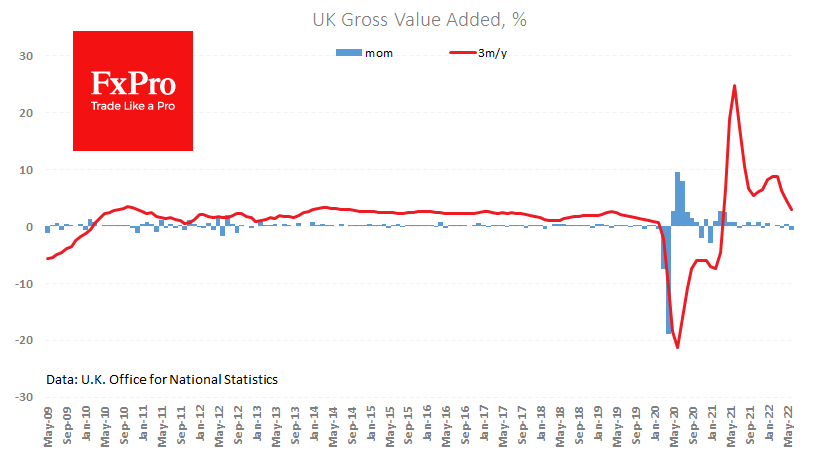

The UK monthly statistics package showed that the economy lost 0.1% in the second quarter (0.2% expected), and the annual growth rate collapsed from 8.7% to 2.9% (2.8% expected). For the month, the decline was 0.6%, half the forecasts.

A similar “better than might have been” is evident in the other indicators released today. Industrial production fell 0.9% against an expected 1.3% and left something from the last month’s gain. Construction dipped 1.4%, against a forecasted 2.0%. The service sector lost 0.4% of its volume, the first contraction since last March.

While this data is better than forecast, it is unlikely to inspire buyers of the pound or investors in the stock market. We see more market sensitivity to price data than the economy.

The GBPUSD is now struggling with downtrend resistance in the form of the 50-day moving average, trying to consolidate higher. On Wednesday, it formally succeeded, but the pound failed to develop the offensive, which might be the first worrying signal that the bears retain control of the markets.

Whether GBPUSD closes the day above 1.22 or below that mark may determine next week’s performance. An ability to stay near or rewrite the local highs would be a bullish signal, sending the sterling further into the 1.25-1.2650 range.

A close on a weak note or a move under 1.2140 would indicate that the recent rebound was only a temporary correction as part of a long-term downtrend. And in this case, GBPUSD could head down with an intermediate target below 1.2000 and a potential next target around 1.1800.

The FxPro Analyst Team