Preliminary UK business activity figures for February surprised on the upside, sending the Pound into a mini rally of 1% within half an hour of publication and supporting prices later in the day.

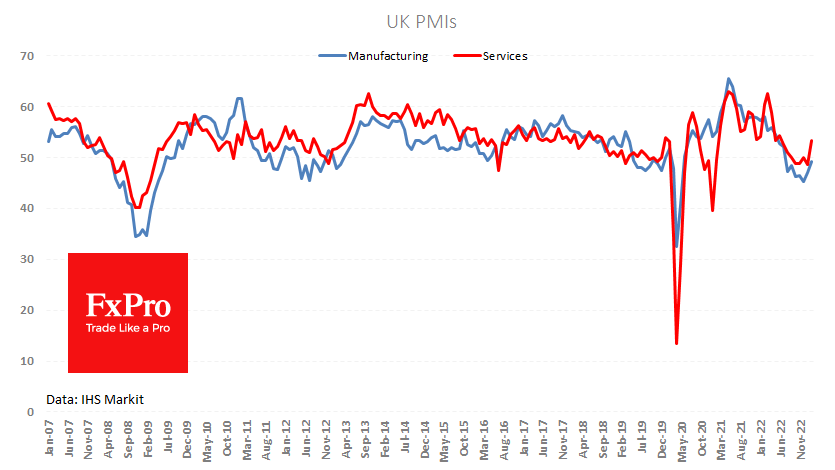

The Manufacturing Business Activity Index climbed from 47.0 to 49.2, with the current reading suggesting a slight contraction in activity and marking the third month of recovery.

The services PMI jumped from 48.7 to 53.3, moving into growth territory, against expectations for a slight increase to 49.2. The latest reading is the highest since last June and has the potential to trigger a notable revision in expectations for the economy and interest rates.

Strong data releases have supported the GBPUSD at a very important time. Late last week, the pair tested support at its 200-day moving average. Buyers actively came to the rescue as the pair fell to the 1.1900 level, and today they are already testing the strength of the 1.2100 level.

On the technical side, a more important short-term level looks to be 1.21500, where the 50 SMA and the area of recent local highs are concentrated and from where the pair was actively sold off precisely a week ago and a correction of 76.4% from the rise from the September lows to the December highs.

For the pair to move higher, it will need increased risk appetite in global markets. And that may be a problem, as US index futures have come under pressure, and the FTSE100 is retreating from its historic highs, back below 8000.

The FxPro Analyst Team