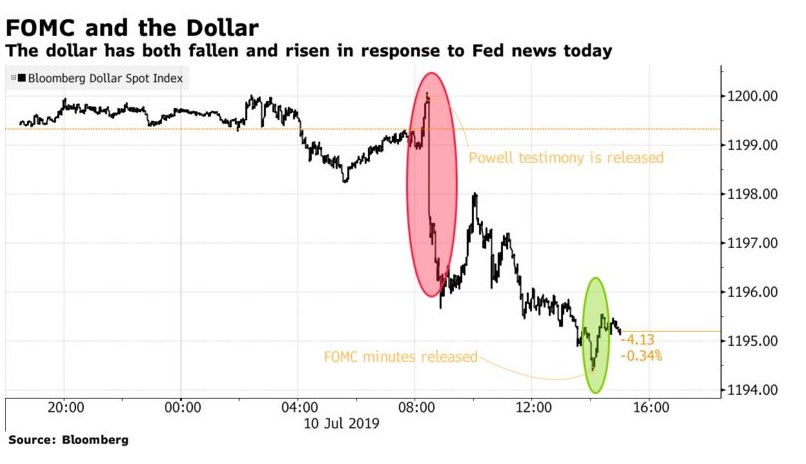

U.S. stocks rose toward all-time highs, gold rallied and the dollar fell as comments by Jerome Powell cemented market bets for a rate cut this month. Treasuries were mixed. Equities that had slumped since Friday’s strong jobs report rallied back to intraday records after the Fed chairman signaled a willingness to lower rates, citing a slowing global economy and trade issues. Minutes from the Fed’s June meeting confirmed an inclination among officials to cut rates soon.

Gains faded as Powell testified to Congress, with financial shares leading the pullback. The S&P 500 briefly topped 3,000 for the first time. “Psychologically, when you hit those round numbers you get a little bit of resistance — you hit it and it fails,” said Aaron Clark, portfolio manager at GW&K Investment Management. “The big round numbers, you tend to get a level that’s tough to power through.”

The yield on 10-year Treasuries fell as low as 2.04% after climbing above 2.10% for the first time in a month before settling around 2.06%. Two-year rates slumped while longer-dated bond yields rose. Powell’s remarks came ahead of two days of testimony in Congress on the economic and policy outlook.

The S&P 500 rose 0.5% to 2,993 as of 4 p.m. New York time. The Dow Jones Industrial Average advanced 0.3%, while the Nasdaq-100 Index gained 1% to a record high. The Stoxx Europe 600 Index declined 0.2%. The MSCI Asia Pacific Index climbed 0.3%. The Bloomberg Commodity Index climbed 1.8%. West Texas Intermediate crude surged 4.4% to $60.35 a barrel. Gold futures rose 1.3% to $1,419 an ounce. The Bloomberg Dollar Spot Index fell 0.3%.