U.S. stocks retreated from more than one-week highs posted amid a flurry of deal activity and signs of progress toward a coronavirus vaccine. The dollar weakened and Treasuries were little changed. The S&P 500 increased as much as 1.9% before paring gains, while the Nasdaq 100 Index broke a two-day slide. Pfizer Inc. Chief Executive Officer Albert Bourla said it’s “likely” the U.S. will deploy a Covid-19 vaccine to the public before year-end.

Global stocks are coming off the back of the first consecutive weeks of declines since March and traders remain on edge given the recent reassessment of valuations and volatility in options markets. The Federal Reserve is expected this week to maintain its dovish stance on policy as investors look for signs the global economy is recovering from the pandemic. Strategists at Goldman Sachs Group Inc. and Deutsche Bank AG suggested the recent pullback in the U.S. is nearing an end.

The pound strengthened against peers as Prime Minister Boris Johnson faced a rebellion in Parliament against legislation that would override key elements of the divorce treaty signed with the European Union. In Asia, stocks rallied with South Korea leading gains. SoftBank Group Corp. shares climbed after Nvidia Corp. agreed to buy the firm’s chip division Arm Ltd. for $40 billion.

China industrial production and retail sales data is due on Tuesday. Wednesday sees the FOMC policy decision and news conference from Chair Jerome Powell. Bank of Japan, Bank Indonesia and Bank of England policy decisions come Thursday.

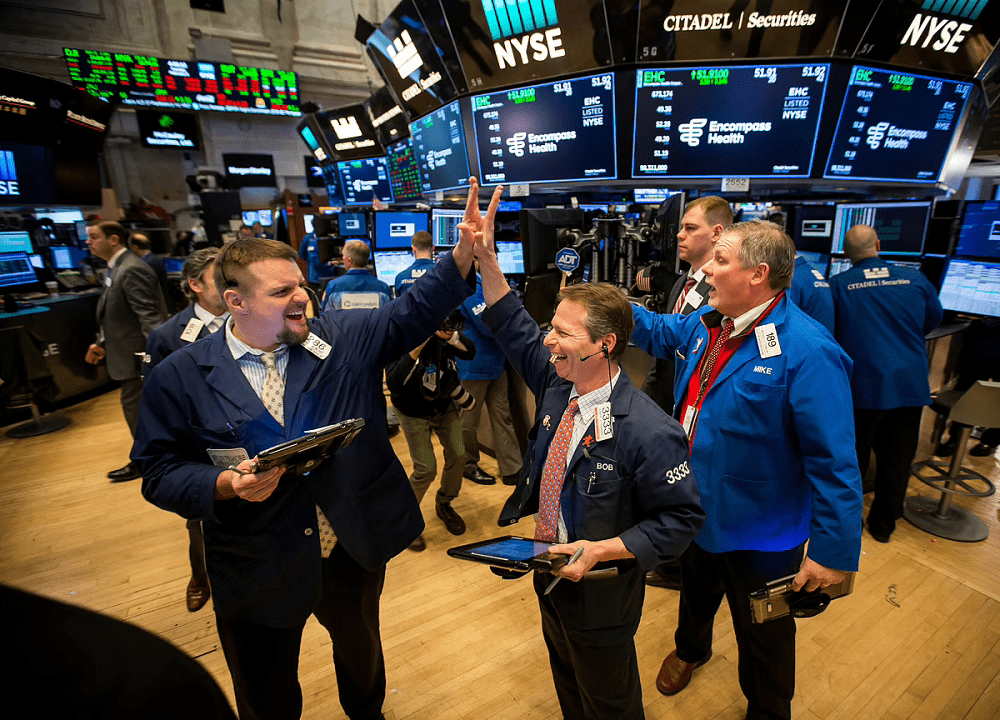

U.S. Stocks Retreat From Week High; Dollar Drops: Markets Wrap, Bloomberg, Sep 14