U.S. stocks drifted mostly higher in thin trading as investors digested this week’s initial burst of corporate earnings, economic data and coronavirus news. The dollar weakened and crude oil fluctuated.

The S&P 500 edged higher, led by gains in utilities, health care and materials, while the communication services and energy sectors slumped. Trading volume was almost 30% below the average over the prior 30 days. Netflix Inc. sank as much as 8.2% after saying it expects to sign up just half the subscribers Wall Street expected in the third quarter. A University of Michigan survey showed U.S. consumer sentiment slumped in July, missing all forecasts, after the resurgent coronavirus nearly wiped out any emerging optimism around reopenings.

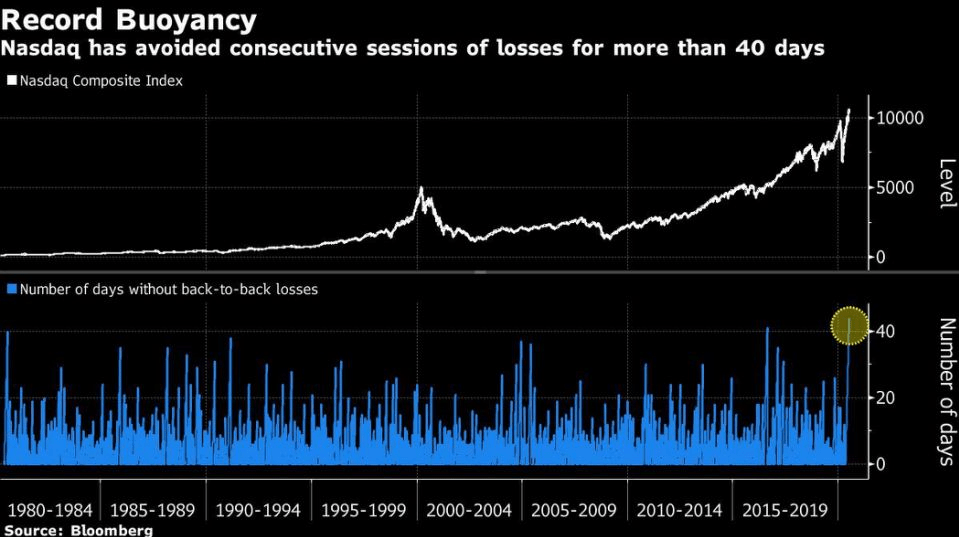

Investors are closely watching to see how the broader technology sector reacts to Netflix’s weaker outlook. The Nasdaq Composite has managed to go two months without posting back-to-back declines, but that’s now under threat as investors question the resilience of tech’s searing rally. Netflix Puts a Record Run of Resilience at Risk in Nasdaq

In Europe, traders are holding out hope for policy makers to conclude a stimulus pact. German Chancellor Angela Merkel raised doubts on Friday that European Union leaders would be able to agree this week on a landmark 750 billion-euro ($855 billion) recovery fund to help their economies heal from the pandemic. Positive earnings from Daimler AG and Ericsson AB pulled carmakers and tech stocks higher.

Elsewhere, Chinese shares were steady after a more than 4% slide on Thursday, with investors assessing moves by policy makers to tame signs of exuberance.

U.S. Stocks Drift Mostly Higher; Dollar Declines: Markets Wrap, Bloomberg, Jul 17