U.S. stock futures were little changed in overnight trading on Tuesday after President Donald Trump called off stimulus talks until after the November election. Dow futures were up down just 3 points. S&P 500 futures sat below the flatline while Nasdaq 100 futures traded marginally higher.

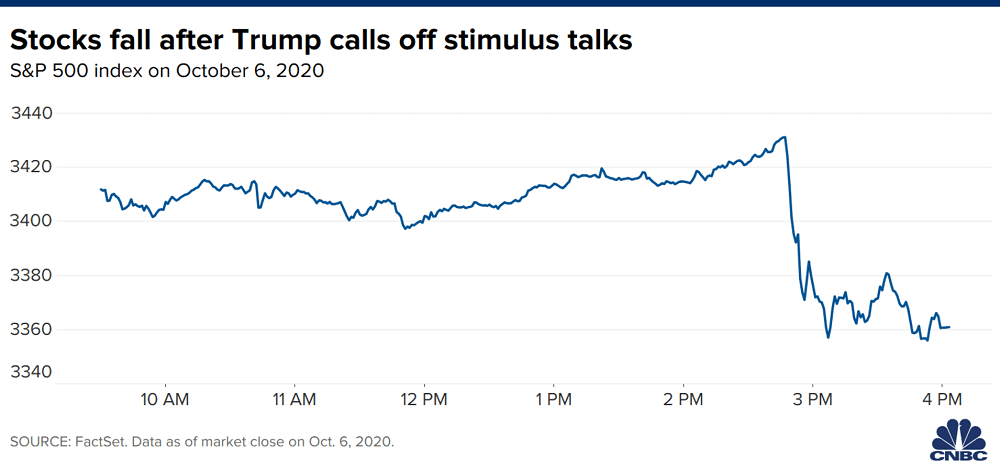

In regular trading on Tuesday, the Dow Jones Industrial Average closed down 375 points after Trump tweeted the White House is halting talks with Democrats about a second coronavirus stimulus deal. Earlier in the session, stocks rallied in hopes that there would be a second relief package to prop up markets as the coronavirus outbreak rages on.

“I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business,” Trump said in a tweet on Tuesday. The S&P 500 lost 1.4% and the Nasdaq Composite fell 1.57% on Tuesday.

Some on Wall Street speculated Trump’s move was a mere negotiating tactic, while others hypothesized the president truly doesn’t think the economy needs another $2 trillion in fiscal spending.

Powell said the lack of support could “lead to a weak recovery, creating unnecessary hardship for households and businesses” and thwart a rebound that thus far has progressed more quickly than expected. “By contrast, the risks of overdoing it seem, for now, to be smaller,” Powell added.

The Federal Open Market Committee will publish its meeting minutes from its September meeting at 2 p.m. ET on Wednesday. The FOMC made no action on interest rates in September, leaving them near zero.

U.S. stock futures little changed after Trump halts stimulus talks, CNBC, Oct 7