Sales of new U.S. single-family homes increased more than expected in May and business activity contracted moderately this month, suggesting the economy was on the cusp of recovering from the recession caused by the COVID-19 crisis.

But a resurgence in confirmed coronavirus cases across the country threatens the nascent signs of improvement evident in Tuesday’s economic data.

New home sales jumped 16.6% to a seasonally adjusted annual rate of 676,000 units last month, the Commerce Department said. New home sales are counted at the signing of a contract, making them a leading housing market indicator. Sales dropped 5.2% in April to a pace of 580,000 units.

Economists polled by Reuters had forecast new home sales, which account for about 14.7% of housing market sales, rising 2.9% to a pace of 640,000 in May.

New home sales are drawn from permits. Sales surged 12.7% from a year ago in May. The report followed on the heels of data last week showing home purchase applications at an 11-year high in mid-June and building permits rebounding strongly in May.

The broader economy slipped into recession in February, leaving nearly 20 million people unemployed as of May.

In a separate report on Tuesday, data firm IHS Markit said its flash U.S. Composite Output Index, which tracks the manufacturing and services sectors, rose to a reading of 46.8 in June from 37 in May. A reading below 50 indicates contraction in private sector output.

The survey’s services sector flash Purchasing Managers Index rose to a reading of 46.7 from 37.5 in May. The contraction in factory activity also ebbed this month, with the flash manufacturing PMI climbing to 49.6 from 39.8 in May.

The improving trend was also echoed in other PMI surveys around the globe. The IHS Markit’s euro zone Flash Composite Purchasing Managers’ Index recovered to 47.5 from May’s 31.9.

Stocks on Wall Street extended gains on the data. The dollar fell against a basket of currencies. U.S. Treasury prices were lower.

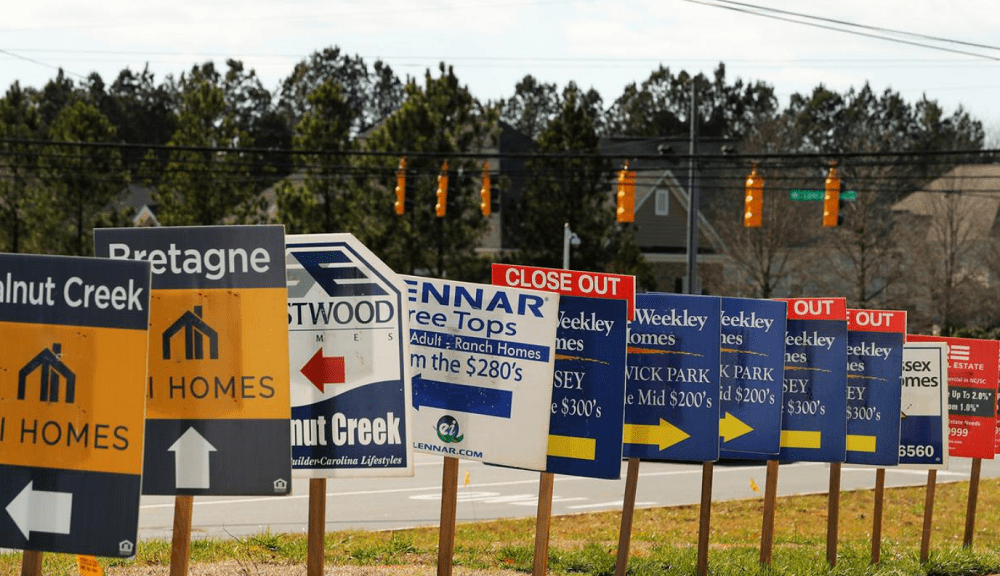

The market for new homes is being supported by historic low interest rates and a preference among buyers for single-family homes away from city centers as companies allow employees more flexibility to work from home amid the coronavirus crisis.

U.S. new home sales rebound; business activity slump easing, Reuters, Jun 23