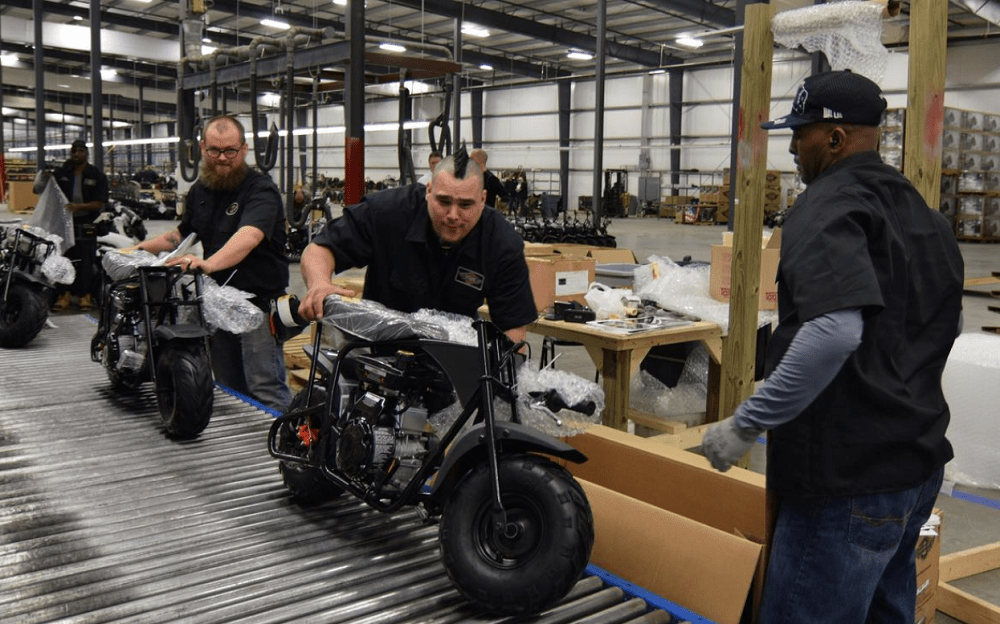

U.S. manufacturing activity accelerated to its highest level in nearly 1-1/2 years in July as orders increased despite a resurgence in new COVID-19 infections, which is raising fears about the sustainability of a budding economic recovery.

The upbeat survey from the Institute for Supply Management (ISM) on Monday, however, likely overstates the health of the manufacturing sector. Caterpillar Inc last week reported lower second-quarter earnings. The heavy equipment maker, viewed as a bellwether for economic activity, said it did not expect an improvement in sales this quarter.

The ISM said its index of national factory activity raced to a reading of 54.2 last month from 52.6 in June. That was the strongest since March 2019 and marked two straight months of expansion. A reading above 50 indicates growth in manufacturing, which accounts for 11% of the U.S. economy. Economists polled by Reuters had forecast the index would rise to 53.6 in July.

The ISM said “manufacturing continued its recovery after the disruption caused by the coronavirus pandemic,” and added that “sentiment was generally optimistic” among manufacturers, continuing a trend from June.

Though factory employment continued to improve last month, it remained in contraction territory. The ISM’s manufacturing employment measure rose to a reading of 44.3 from 42.1 in June. Factory employment was already in decline because of the Trump administration’s trade war with China.

A separate report from the Commerce Department on Monday showed construction spending dropped 0.7% in June after decreasing 1.7% in May. The third straight monthly decline pushed outlays to a one-year low of $1.355 trillion. Economists had forecast construction spending would rebound 1.0% in June. Construction spending edged up 0.1% on a year-on-year basis.

Spending on private construction projects slipped 0.7%. Spending on residential projects fell 1.5%, offsetting a 0.2% gain in outlays on nonresidential construction projects such as manufacturing and power plants. Spending on public construction projects dropped 0.7%.

U.S. manufacturing activity near 1-1/2-year high; construction spending extends drop, Reuters, Aug 3