The U.S. stock market continues its rally despite disappointing job numbers. After sharp rebounds in May and June, the U.S. labor market showed signs of slowing in July. According to the ADP National Employment report, private-sector employment increased by only 167,000 from June to July. This total was well below Wall Street’s estimate of 1 million and represented a drop from the 4.314 million jobs created in June.

All jobs except 1,000 were in the service sector. The slowdown is attributable to the leisure and hospitality sector, which created 38,000 jobs against nearly 2 million in June. The June total was revised significantly higher than the roughly 2.4 million in the original estimate. That month, combined with May’s 3.34 million increase, still leaves the job market well short of the 19.7 million jobs lost in March and April.

ADP data are a good indicator of what to expect in the more closely watched jobs report from the Labor Department. On Tuesday, President Trump hinted that the government would release a strong employment report at the end of the week. That number might not be as significant as Trump hopes, though. Dow Jones expects nonfarm payrolls to grow 1.48 million after last month’s record 4.8 million.

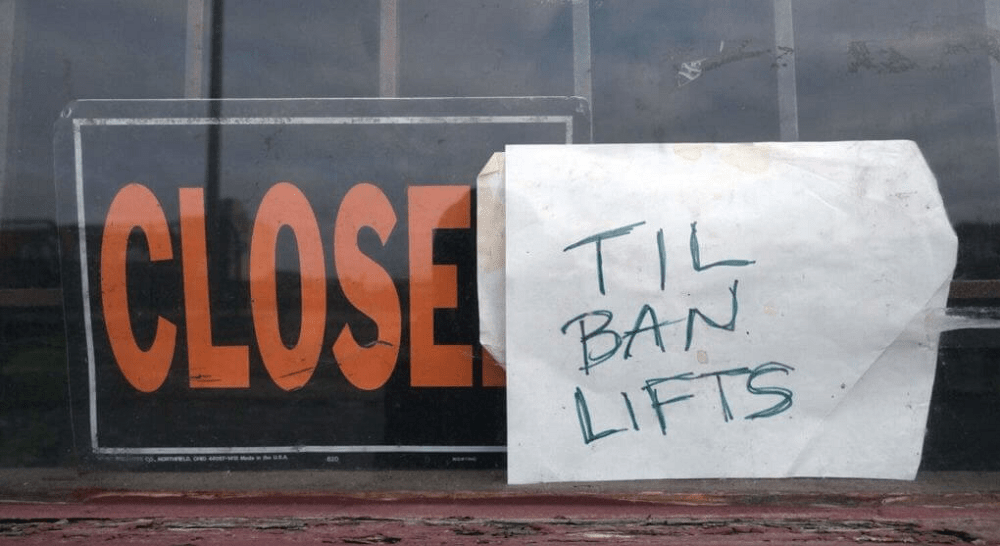

There will likely be not enough jobs to support economic growth. The main driver of the stock market rally is vaccine hopes. The reality is that a vaccine won’t be a silver bullet, as the virus could be with us for decades. Strategist David Hunter predicts the stock market could crash by 80% once investors realize the long-term economic damage caused by the pandemic. The stock market won’t stay disconnected from the economy forever. The bubble will pop sooner or later.

U.S. Jobs Recovery Is Losing Steam. So Will the Stock Market Rally, CCN, Aug 6