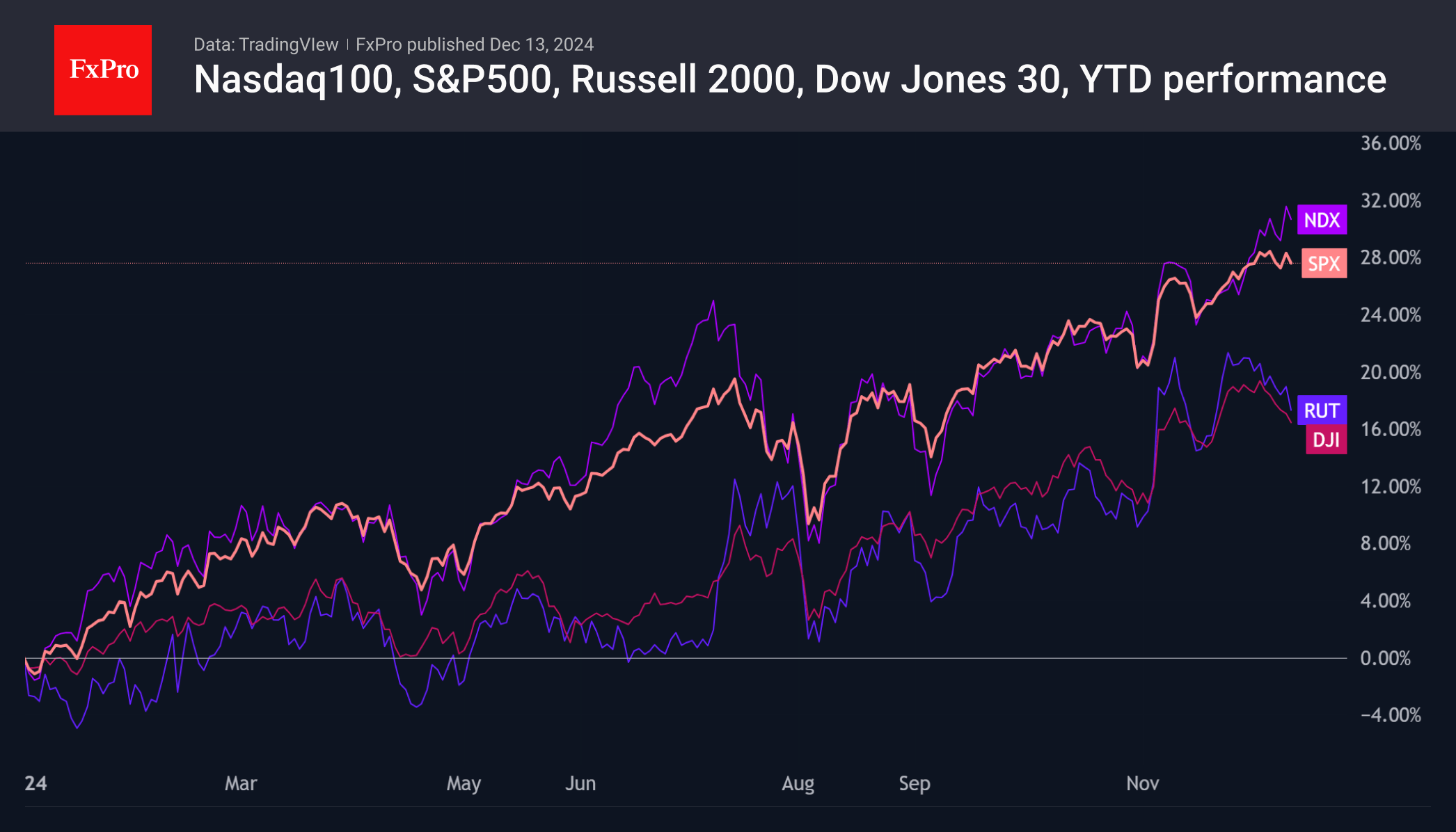

The dollar’s rise in the latest week weighed on the Dow Jones and Russell 2000 indices, which fell 2.8% and 4.8%, respectively, from their recent highs. However, the Nasdaq100 was boosted by the success of the high-tech giants. This index approached 21800, moving further into all-time high territory.

This kind of divergence is not sustainable. This means that in the next week or two, we will either see an acceleration in the Russell and Dow or a correction in the S&P500 and Nasdaq100. A rising dollar argues for the second scenario, but the Fed’s comments could dramatically change sentiment.

The FxPro Analyst Team