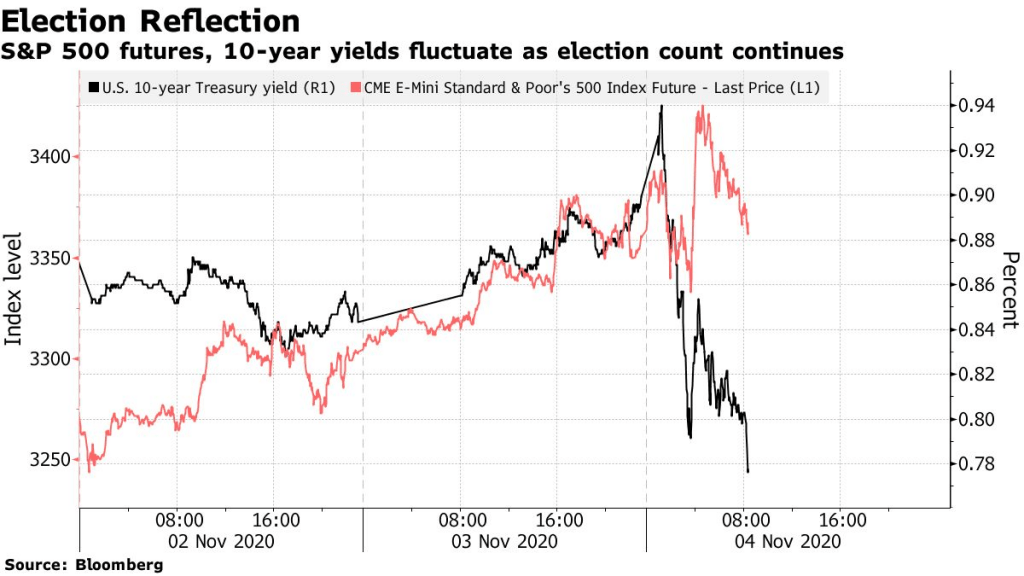

S&P 500 futures fell and Treasuries rose on concern the U.S. is heading for a contested election after President Donald Trump called for the Supreme Court to intervene. Contracts on the S&P 500 sank 0.4%, erasing an earlier advance. Ten-year Treasury yields dropped to 0.77% and the dollar advanced gainst peers. The offshore yuan and Mexican peso retreated and gold slipped. European stocks opened lower. Trump falsely declared early Wednesday he had won re-election against Democratic nominee Joe Biden, even as several battleground states continued to count votes.

The comments sent a shockwave through global markets that have been anxious over the prospect of a drawn-out legal battle for the U.S. presidency. While Biden had solid lead in the polls, it’s becoming clear that the race is going to be far closer than expected.

Earlier, Biden said he feels good about his chances to win the presidency, cautioning supporters that it would take time to finish counting the votes. “Early prospects for a quick resolution to the U.S. election have given way to the reality of an extended process, not only with regards to the White House but also the Senate,” said Ian Lyngen, a strategist at BMO Capital Markets. “Volatile price action can only be expected to persist for the time being, at least until the path forward becomes clearer.”

These are some key events coming up:

-EIA crude oil inventory report on Wednesday.

-Federal Reserve policy decision on Thursday.

-The key U.S. non-farm payrolls report is due Friday.

-Earnings are due this week from companies including AstraZeneca Plc, Nintendo Co., Macquarie Group Ltd. and Toyota Motor Corp.

These are some of the main moves in financial markets:

Stocks

Futures on the S&P 500 Index fell 0.4% as of 8:02 a.m. London time.

The Stoxx Europe 600 Index surged 2.3%.

The MSCI Asia Pacific Index gained 0.3%.

The MSCI Emerging Market Index was little changed.

Currencies

The Bloomberg Dollar Spot Index jumped 0.6% to 1,174.16.

The euro declined 0.5% to $1.1659.

The British pound dipped 0.8% to $1.2949.

The Japanese yen weakened 0.4% to 104.92 per dollar.

Bonds

The yield on 10-year Treasuries decreased 12 basis points to 0.77%.

The yield on two-year Treasuries dipped one basis point to 0.15%.

Germany’s 10-year yield sank four basis points to -0.66%.

Britain’s 10-year yield increased five basis points to 0.272%.

Commodities

West Texas Intermediate crude declined 1.4% to $37.60 a barrel.

Gold weakened 0.9% to $1,891.30 an ounce.

U.S. Futures Slump as Treasuries; Dollar Advance: Markets Wrap, Bloomberg, Nov 4