U.S. stock futures turned lower with European equities as investors assessed the dimmed outlook for fiscal stimulus and for any tech-stock reboud after Wednesday’s tumble. Nasdaq 100 contracts signaled the gauge may fall further after its biggest drop in a month on news that Facebook Inc. was being sued by U.S. antitrust officials. The social media giant slipped further in pre-market trading on Thursday.

In Europe, gains in food and beverage shares were undercut by declines in technology stocks. STMicroelectronics NV dropped as much as 3.3%, extending Wednesday’s 12% plunge that followed the chipmaker’s disappointing medium-term outlook.

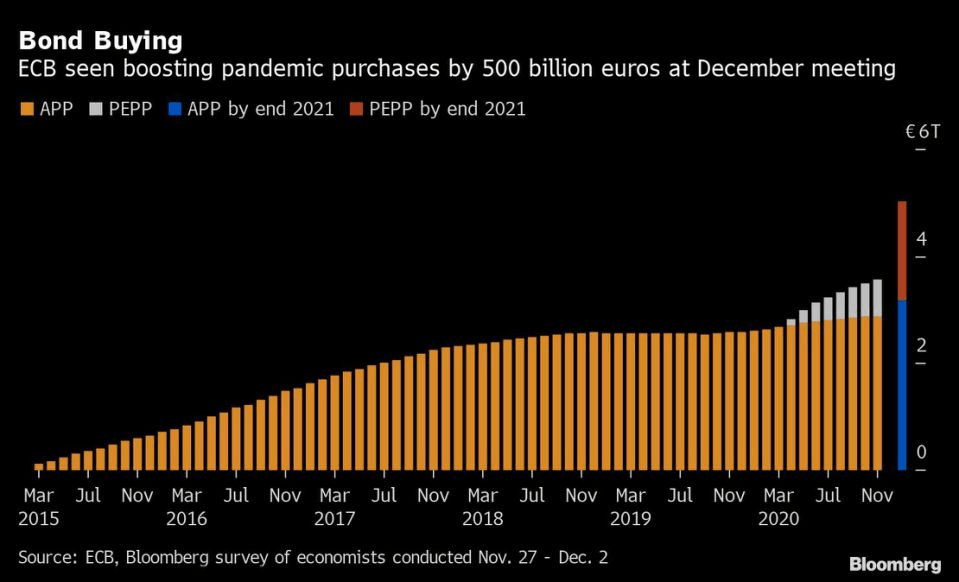

The pound sank further after a report that talks between the EU and the U.K. are on course to end without a trade deal, barring a dramatic last-minute intervention. The euro erased earlier gains just before the European Central Bank policy decision that’s expected to add 500 billion euros ($605 billion) to its emergency bond-buying program.

The post-October rally in global equities has slowed this week as the pandemic proves unrelenting and negotiations over a U.S. aid package seem bogged down. That has investors counting on continued easing and bond buying by central banks to support risk assets and possibly reflation into 2021, including the ECB decision today.

Here are some key events coming up:

The FDA meets to discuss the vaccine made by Pfizer/BioNTech on Thursday.Jobless claims data are due in the U.S. on Thursday.

Here are some of the main market moves:

Stocks

Futures on the S&P 500 Index decreased 0.2% as of 7:25 a.m. New York time.Nasdaq 100 Index futures dipped 0.4%.The Stoxx Europe 600 Index fell 0.1%.The MSCI Asia Pacific Index fell 0.4%.

Currencies

The Bloomberg Dollar Spot Index rose 0.1%.The British pound dipped 0.9% to $1.3272.The Japanese yen weakened 0.2% to 104.49 per dollar.The Turkish lira weakened 0.5% to 7.867 per dollar.

Bonds

The yield on 10-year Treasuries fell two basis points to 0.92%.Britain’s 10-year yield declined six basis points to 0.198%.Germany’s 10-year yield decreased two basis points to -0.63%.Australia’s 10-year yield declined four basis points to 0.9905%.

Commodities

West Texas Intermediate crude climbed 1.3% to $46.13 a barrel.Gold weakened 0.1% to $1,837.95 an ounce.Iron ore gained 5.7% to $155 per metric ton.Wheat increased 1.7% to $5.93 a bushel.

U.S. Futures Drop After Tech Slide; Pound Slumps: Markets Wrap, Bloomberg, Dec 10