Markets were mildly risk-off on Monday as investors weighed strong economic data from China, U.S. President-elect Joe Biden’s stimulus plans and surging coronavirus trends. Carrefour SA tumbled 5.8%, leading Europe’s Stoxx 600 lower, after Canada’s Alimentation Couche-Tard Inc. abandoned talks on a $20 billion merger. The dollar ticked higher, oil prices were weaker and U.S. equity futures dipped.

Asian chip stocks and Huawei Technologies Co. suppliers dropped after Reuters reported that the U.S. is planning to revoke their licenses to work with the Chinese company. In Seoul, Samsung Electronics Co. fell 3.4%. “Markets needed a breather or even a pull back to justify reflationary expectations,” said Ben Emons, managing director of global macro strategy at Medley Global Advisors.

Global shares slipped last week after optimism about the $1.9 trillion U.S. aid package, and the so-called reflation trade, faltered into a holiday weekend. U.S. financial markets are closed Monday for the Martin Luther King holiday.

Meanwhile, Janet Yellen is expected to affirm the U.S.’s commitment to market-determined exchange rates and provide assurances that the U.S. won’t seek a weaker currency for competitive trade advantages, the Wall Street Journal reported, citing Biden transition officials familiar with preparation for her confirmation hearing as Treasury Secretary.

On the coronavirus front, cases topped 95 million, while the U.S. death toll from Covid-19 neared 400,000. Norway expressed increasing concern about the safety of the Pfizer Inc. vaccine on elderly people with serious underlying health conditions after deaths in 29 people who received inoculations.

Stocks

Futures on the S&P 500 Index fell 0.2% as of 9:01 a.m. London time.The Stoxx Europe 600 Index declined 0.2%.The MSCI Asia Pacific Index decreased 0.4%.The MSCI Emerging Market Index fell 0.2%.

Currencies

The Bloomberg Dollar Spot Index climbed 0.3% to 1,129.08.The euro declined 0.1% to $1.2071.The British pound decreased 0.5% to $1.3527.The Japanese yen strengthened 0.1% to 103.78 per dollar.

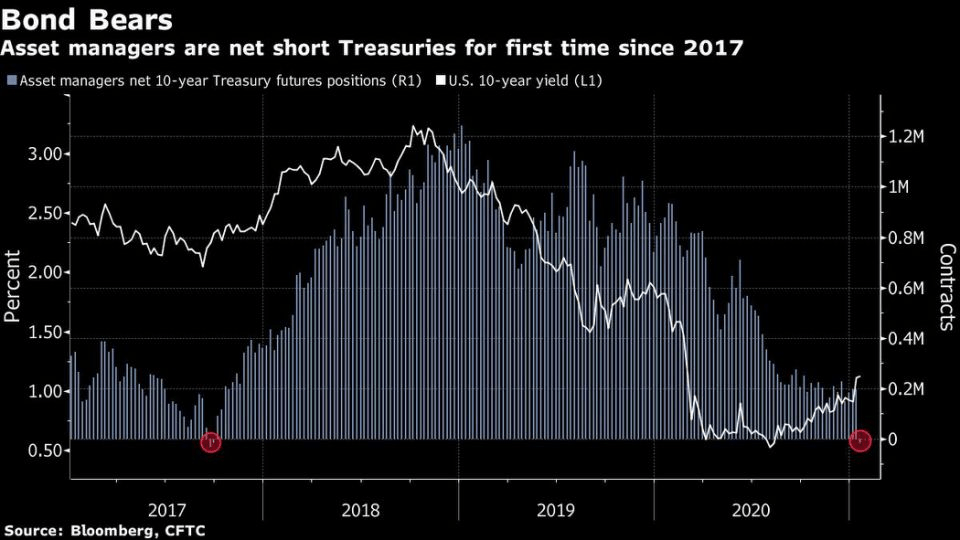

Bonds

Germany’s 10-year yield fell one basis point to -0.55%.Britain’s 10-year yield decreased one basis point to 0.28%.

Commodities

West Texas Intermediate crude fell 0.3% to $52.22 a barrel.Gold strengthened 0.3% to $1,833.63 an ounce.

U.S. Equity Futures Retreat, Dollar Edges Higher: Markets Wrap, Bloomberg, Jan 18